Nordex: Windy times ahead

Purpose

Nordex SE is a German company that develops, manufactures, maintains and sells wind turbines. Since the merger with Acciona Windpower in 2016, the Nordex Group has become a global player and one of the largest manufacturers of wind turbines in the world. The highly efficient wind turbines generate electricity economically at locations with a wide range of geographical and climatic conditions. The comprehensive product portfolio offers high-performance turbines for markets with limited space as well as for regions with limited grid capacity, which are designed to ...

Nordex SE is a German company that develops, manufactures, maintains and sells wind turbines. Since the merger with Acciona Windpower in 2016, the Nordex Group has become a global player and one of the largest manufacturers of wind turbines in the world. The highly efficient wind turbines generate electricity economically at locations with a wide range of geographical and climatic conditions. The comprehensive product portfolio offers high-performance turbines for markets with limited space as well as for regions with limited grid capacity, which are designed to continuously reduce the cost of electricity generation.

As one of the pioneers in the wind energy sector, the Nordex Group has developed and launched numerous groundbreaking products since its foundation in 1985 - from the first series production of turbines in the 1 MW segment in 1985, to the introduction of 2.5 MW turbines in 2000 and the market launch of the N149/4.0-4.5, the world's first 4MW+ class turbine in 2017.

The current focus is on wind turbines in the 4+ to 6+ MW class. In some markets, the Nordex Group is also active as a project developer for wind farms. The Nordex Group manufactures nacelles, rotor blades and concrete towers in production facilities in Germany, Spain, Brazil, the USA and India. The company also has branches and offices in more than 30 countries. Nordex SE is a listed company and its shares are included in the TecDAX and MDAX on the Frankfurt Stock Exchange. The company's head office, including the Management Board and central Group functions, is in Hamburg, while the legal headquarters are in Rostock. The free float is 50%.

Analysis

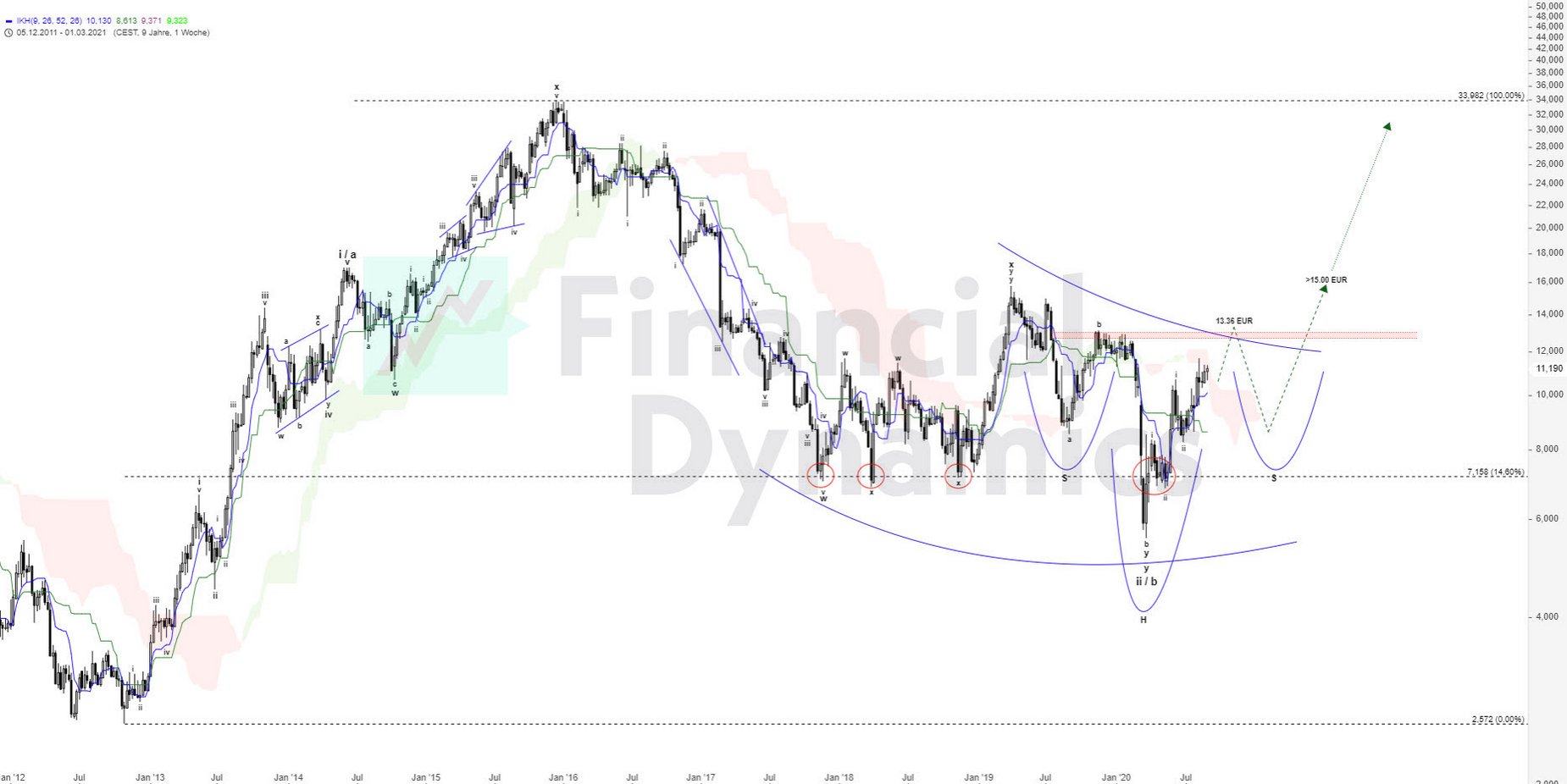

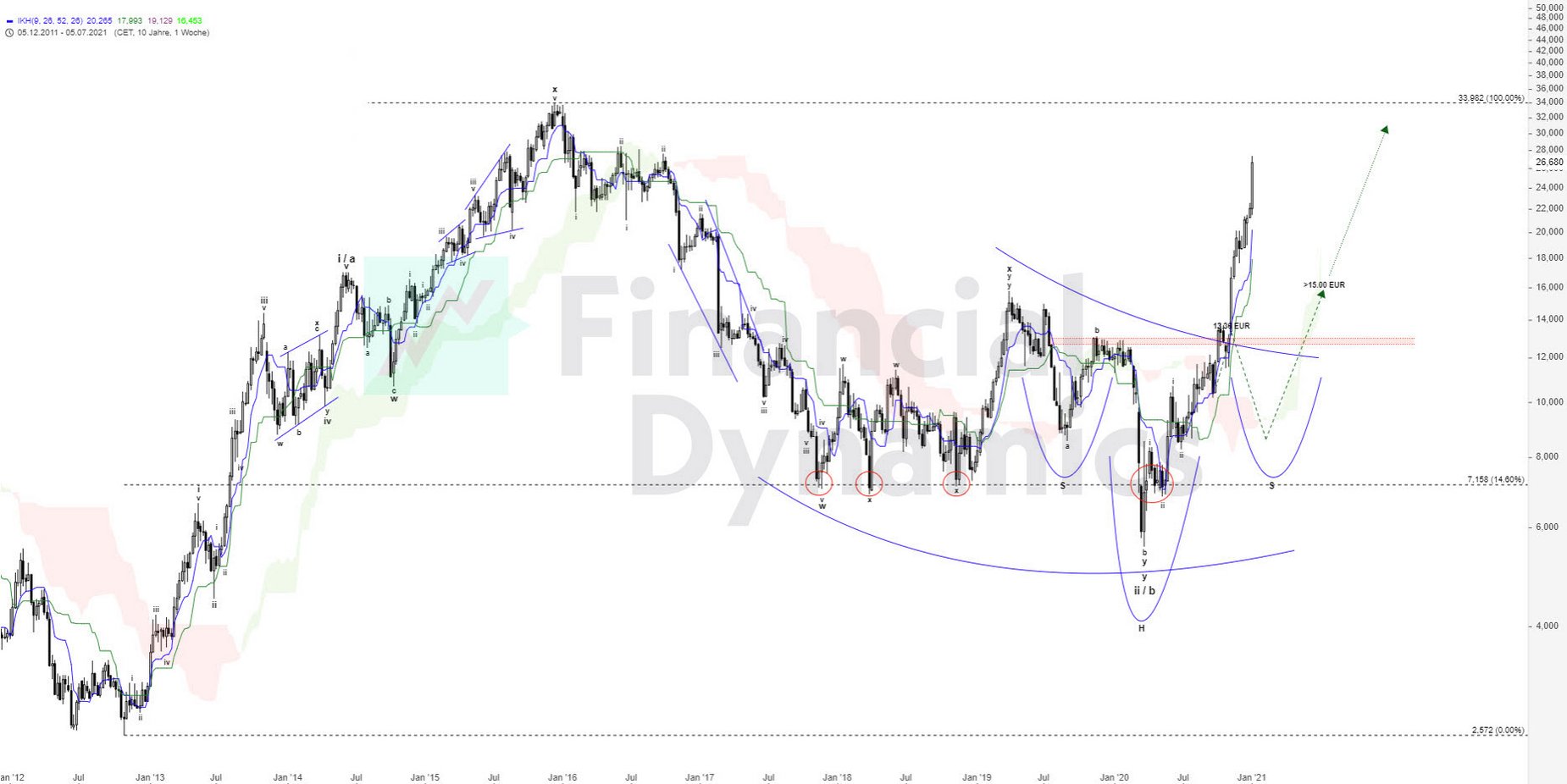

In recent years, the Nordex share price has experienced some extreme fluctuations. Since 2012, the price has fluctuated between around EUR 2.50 and a high of almost EUR 34 at the end of 2015, only to fall back to around EUR 5.55 during the coronavirus crisis. This turbulence is primarily due to the dependence on government orders. In the current economic situation, however, Nordex could be relatively stable, as it is expected that government stimulus programs will be introduced to overcome the challenges caused by the pandemic and global uncertainty. This could not ...

In recent years, the Nordex share price has experienced some extreme fluctuations. Since 2012, the price has fluctuated between around EUR 2.50 and a high of almost EUR 34 at the end of 2015, only to fall back to around EUR 5.55 during the coronavirus crisis. This turbulence is primarily due to the dependence on government orders. In the current economic situation, however, Nordex could be relatively stable, as it is expected that government stimulus programs will be introduced to overcome the challenges caused by the pandemic and global uncertainty. This could not only improve the company's own order situation, but also enable the government to increase its economic output - a thoroughly strategic move.

According to the Elliott Wave Theory, Nordex could now have completed a three-year correction phase and be in the early stages of a new upswing. A decisive moment will be reached when the share price exceeds the EUR 13.16 mark, which can be seen as confirmation of its upward trend.

Conclusion

- The support level of EUR 8.26 could provide the basis for a potential price increase.

- A breakthrough above EUR 13.36 could attract further momentum and investor interest.

- The dependence on government orders could promote the stability of Nordex stock in uncertain times.

Nordex

- VALOR 2083267

- ISIN DE000A0D6554

- Author Oliver Dolezel

- Date 02.09.20

Analysis Performance

Performance since initial analysis

02.09.20

No rating available yet.

Comments

No comments yet.