Kupfer: Will remain under power

Purpose

Copper is one of the most important metals in the global economy and ranks third in metal consumption after iron and aluminum. In its pure form, copper is a hard but easily malleable heavy metal with a characteristic bright red color. Thanks to its numerous positive properties - such as excellent electrical conductivity, corrosion resistance and easy formability - copper is used in many industries and areas of life.

Copper has been used for thousands of years and is an essential component of bronze and brass alloys. The oldest finds of worked copper come from Anatolia ...

Copper is one of the most important metals in the global economy and ranks third in metal consumption after iron and aluminum. In its pure form, copper is a hard but easily malleable heavy metal with a characteristic bright red color. Thanks to its numerous positive properties - such as excellent electrical conductivity, corrosion resistance and easy formability - copper is used in many industries and areas of life.

Copper has been used for thousands of years and is an essential component of bronze and brass alloys. The oldest finds of worked copper come from Anatolia and date back to the 8th millennium BC. Due to its widespread use in antiquity, the 4th and 3rd millennia BC are also referred to as the “copper age”. At that time, copper was initially used in its pure form, but was later increasingly processed in alloys with other metals.

Copper is an excellent conductor of electricity and heat and is therefore mainly used in the electrical industry. Copper is also used for alloys such as brass and bronze, in the jewelry industry and as a coin metal. For example, the gold-colored euro coins are made of an alloy consisting of copper, zinc, aluminum and tin. In addition to its use in alloys, pure copper is still used today for coins and pipes, as it is easily malleable and hardly corrodes. The combination of its many good properties, such as excellent conductivity and corrosion resistance, makes copper an indispensable material in modern technology. In addition, copper is 100% recyclable without any loss of quality, making it a sustainably valuable raw material.

There are numerous copper deposits around the world, but the largest reserves are in Chile and the USA. Together, these two countries account for around 20 percent of the world's copper deposits. In recent years, however, the recycling of copper has also become very widespread. As a result, around 10 percent of global copper demand can be met, and in some countries even a significantly larger proportion.

Chile is the largest supplier of copper, accounting for around a third of global mine production. It is followed by Peru and the USA. As copper can be recycled almost indefinitely, recycling plays a key role alongside new extraction from mines. In the USA, one of the largest consumers, around a third of the copper used comes from recycling.

Analysis

Copper is an essential metal for the energy transition. The e-car trend alone will cause demand for this metal to rise sharply. With the second-highest electrical conductivity after silver, it is irreplaceable in the electronics sector. We are also increasingly facing a situation where demand is outstripping supply (deficit). This is because it is becoming increasingly difficult to find new deposits that can be mined profitably at current prices. From a technical perspective too, prices are actually too low from a historical perspective - particularly in view of the ...

Copper is an essential metal for the energy transition. The e-car trend alone will cause demand for this metal to rise sharply. With the second-highest electrical conductivity after silver, it is irreplaceable in the electronics sector. We are also increasingly facing a situation where demand is outstripping supply (deficit). This is because it is becoming increasingly difficult to find new deposits that can be mined profitably at current prices. From a technical perspective too, prices are actually too low from a historical perspective - particularly in view of the fundamental situation. While the stock markets are reaching one all-time high after another, copper is still valued very low in historical terms. In addition, there could still be considerable upside potential here.

Conclusion

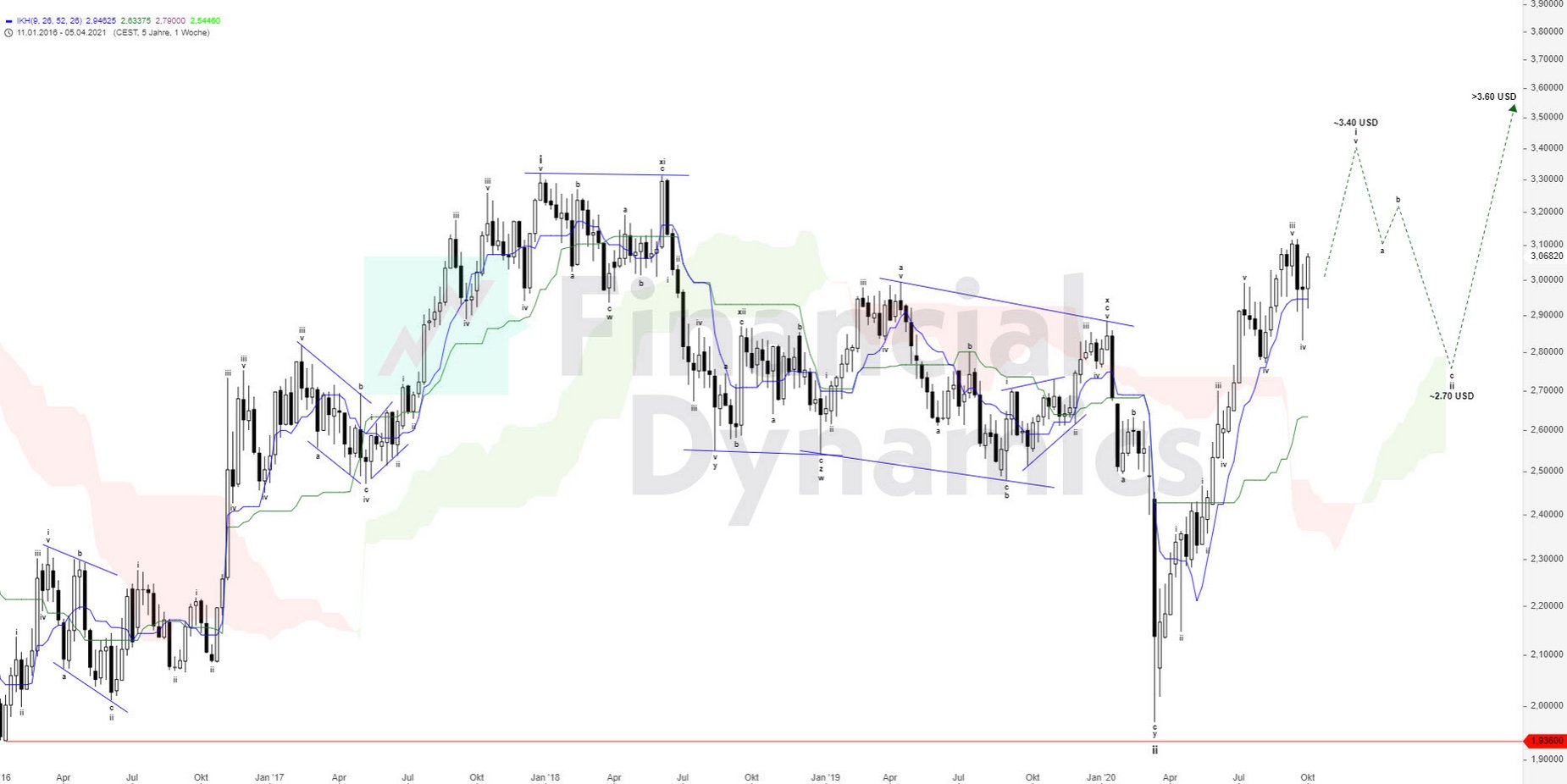

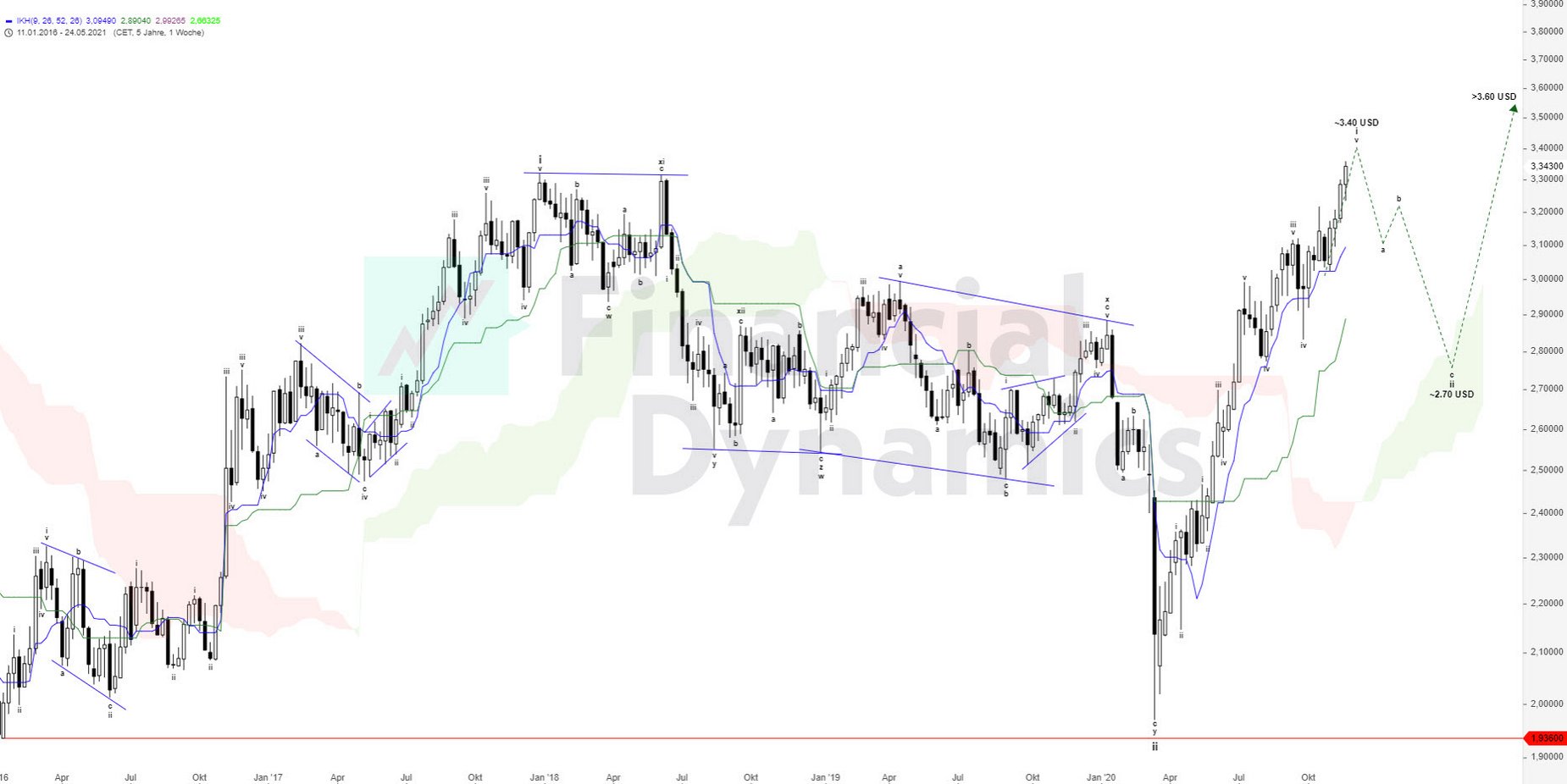

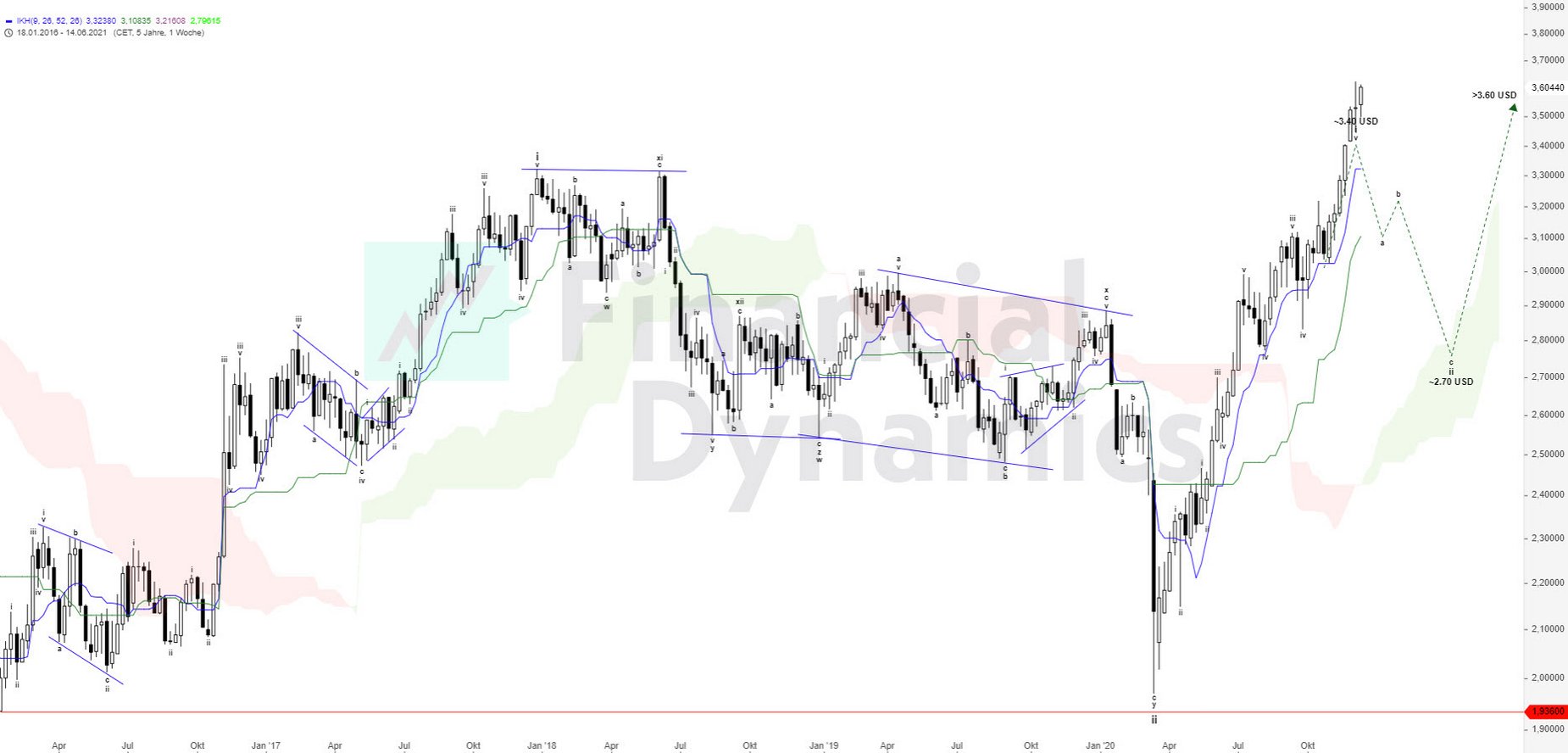

- We expect the price of copper to rise to around USD 3.40.

- A possible correction could lead to a low of USD 2.70.

- In the long term, we see the trend continuing above USD 3.60.

Kupfer

- VALOR 2723229

- ISIN GB00B15KXQ89

- Author Oliver Dolezel

- Date 09.10.20

Analysis Performance

Performance since initial analysis

09.10.20

No rating available yet.

Comments

No comments yet.