Vestas: The windy outperformer.

Purpose

Vestas Wind Systems A/S is a company active in the renewable energy and power sectors. Vestas is a leading manufacturer of wind turbines with the world's highest installed capacity. The company operates in two business areas: Power Solutions and Services. The Power Solutions segment develops, manufactures and installs onshore and offshore wind turbines, while the Services segment carries out operation and maintenance work on wind turbines. The core business of the Danish wind power company includes the development, production, sale and maintenance of technologies that ...

Vestas Wind Systems A/S is a company active in the renewable energy and power sectors. Vestas is a leading manufacturer of wind turbines with the world's highest installed capacity. The company operates in two business areas: Power Solutions and Services. The Power Solutions segment develops, manufactures and installs onshore and offshore wind turbines, while the Services segment carries out operation and maintenance work on wind turbines. The core business of the Danish wind power company includes the development, production, sale and maintenance of technologies that convert wind energy into electricity. Other core competencies include the planning, installation, operation and maintenance of wind turbines. Vestas also offers its customers advice on the development and financing of wind energy projects and on ownership issues.

In Aarhus, Denmark, Vestas operates the world's largest research and development center for wind energy. The company is also increasingly designing and producing turbines for low-wind regions such as Bavaria and Baden-Württemberg. Vestas wind turbines are located in 70 countries on six continents. Vestas' competitors include companies such as E.ON, Nordex and Vattenfall Europe. The share has a very high free float of 97.1%.

Analysis

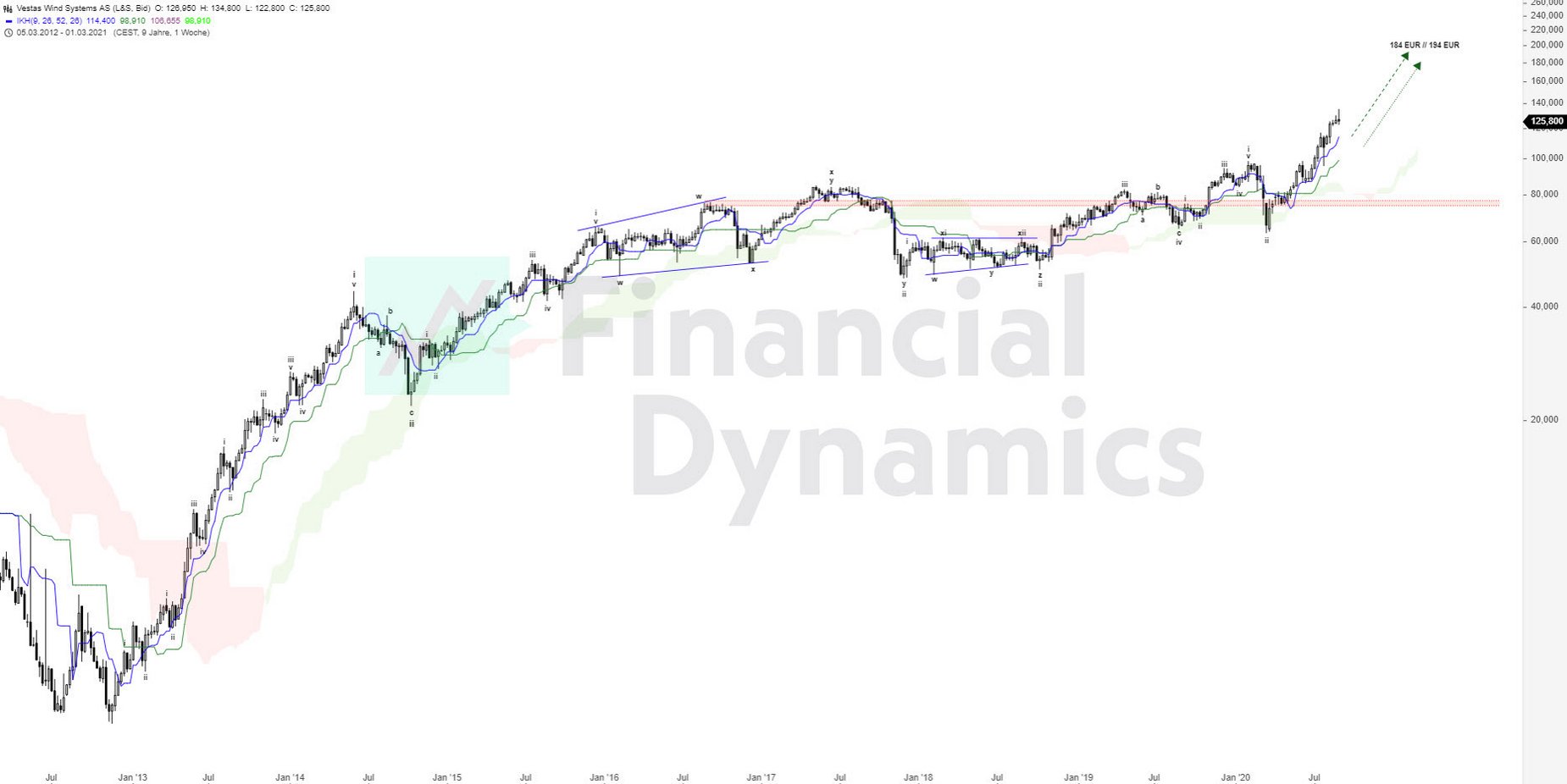

In our current analysis of the Vestas Wind Systems share, we see promising developments that point to further share price growth. There are two key reasons behind our optimistic assessment: Firstly, the energy policy environment is improving, which is further boosting demand for renewable energies. Secondly, the technical chart setup is promising, as the share is in a clear upward cycle. However, there are also potential warning signals: if the share reaches the forecast price targets, there could be a longer phase of consolidation before upward movements can be ...

In our current analysis of the Vestas Wind Systems share, we see promising developments that point to further share price growth. There are two key reasons behind our optimistic assessment: Firstly, the energy policy environment is improving, which is further boosting demand for renewable energies. Secondly, the technical chart setup is promising, as the share is in a clear upward cycle. However, there are also potential warning signals: if the share reaches the forecast price targets, there could be a longer phase of consolidation before upward movements can be expected again.

Conclusion

- We expect the Vestas share to reach price targets of EUR 184 and EUR 194.

- Once these targets have been reached, a dry spell could lie ahead.

It is advisable to exercise caution above these levels.

Note: Due to the share split of 1:5, the price targets also had to be adjusted according to this factor. The charts in the analysis show the price targets before the stock split.

Vestas

- VALOR 111042507

- ISIN DK0061539921

- Author Oliver Dolezel

- Date 05.09.20

Analysis Performance

Performance since initial analysis

05.09.20

No rating available yet.

Comments

No comments yet.