Tencent: Still a pretty safe bet in the long run.

Purpose

Tencent Holdings Limited is an investment holding company mainly engaged in value-added services (VAS) in telecommunications, online advertising, FinTech and business services in the People's Republic of China and internationally. The company operates one of the largest and busiest service portals in the People's Republic. The company offers a wide range of Internet and mobile communication solutions, including the instant messaging service QQ, the online portal QQ.com, a gaming platform, a multimedia social network service, a Chinese online community, live streaming, ...

Tencent Holdings Limited is an investment holding company mainly engaged in value-added services (VAS) in telecommunications, online advertising, FinTech and business services in the People's Republic of China and internationally. The company operates one of the largest and busiest service portals in the People's Republic. The company offers a wide range of Internet and mobile communication solutions, including the instant messaging service QQ, the online portal QQ.com, a gaming platform, a multimedia social network service, a Chinese online community, live streaming, news, music and literature, fintech services such as mobile payments, asset management, loans and securities trading, as well as various tools such as network security management, browsers, navigation, application management, e-mail, etc.

The company's aim is to provide users with information as well as entertainment, communication and e-commerce solutions through a variety of different media offerings. The company holds a number of technology patents, including in the areas of instant messaging, e-commerce, mobile payment solutions, search engines, internet security and online games. The company's business also includes marketing solutions that provide digital tools such as user insights, creativity management, placement strategies and digital asset management. Tencent operates the Tencent Research Institute, one of the first Chinese Internet research institutes with branches in Beijing, Shanghai and Shenzhen. Competitors include China Mobile, China Telecom, China Unicom, PCCW, Tata Communications and Tencent Holdings.

Analysis

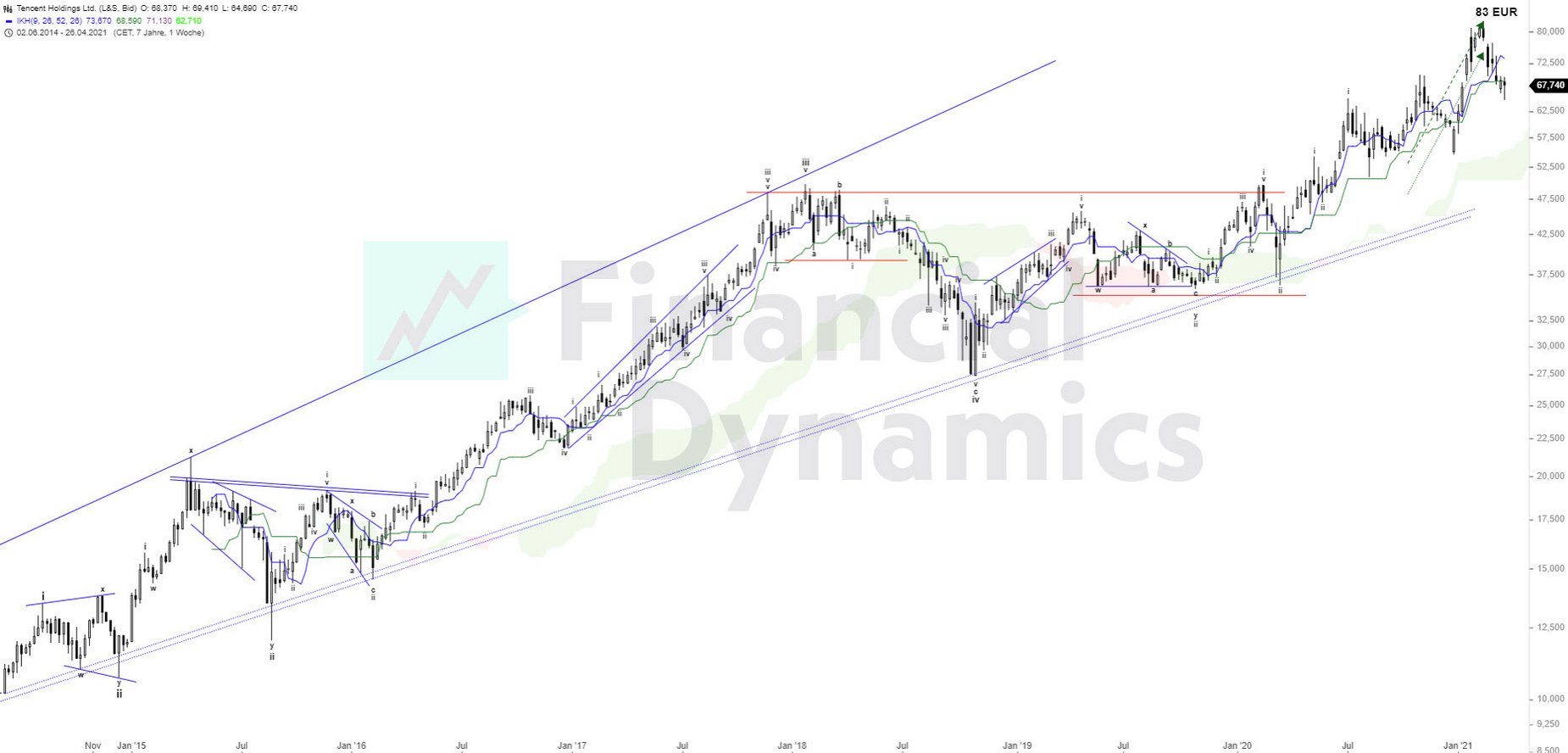

Tencent was already a clear long-term buy years ago. And even after its very good performance, it remains a buy. At least if you do not yet have any Tencent shares in your portfolio, you should consider buying at least a first tranche. According to the EW theory, a further correction of 10-15% could occur at any time. The overall trend should continue upwards. As can easily be seen in the following profit and sales chart, the company is on a solid growth path.

Conclusion

- A sensible stop cannot be set according to the EW theory. The bull market is intact as long as the share price remains above EUR 36. The share price is more than 36 % away from this level.

- The achievable price target for the coming months/years is currently set at EUR 83. That would still be around 45 % of the current level.

Tencent

- VALOR 4752662

- ISIN US88032Q1094

- Author Oliver Dolezel

- Date 16.09.20

Analysis Performance

Performance since initial analysis

16.09.20

No rating available yet.

Comments

No comments yet.