Platin: Still a bit hesitant, BUT...

Purpose

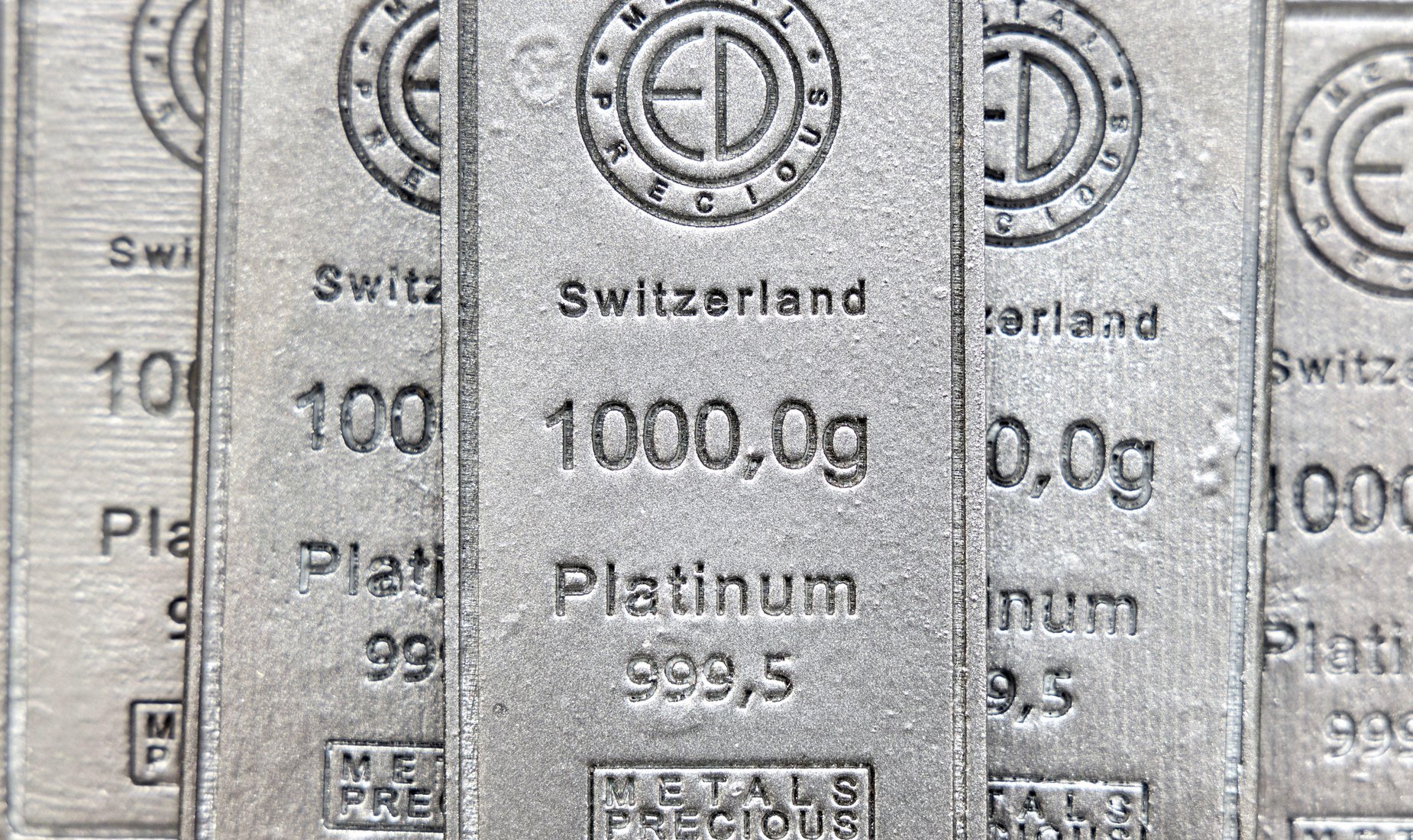

Platinum is one of the rarest and most valuable precious metals in the world. Once the most expensive precious metal, it has since been replaced by gold in this position. Nevertheless, platinum remains in demand due to its exceptional properties and low availability. The high price of platinum results from its rarity and the complex extraction methods: one ounce of platinum, which usually has a purity of 95%, is extracted from ten tons of ore. This extraction process takes around five months.

South Africa is the world's most important producer of platinum and the only ...

Platinum is one of the rarest and most valuable precious metals in the world. Once the most expensive precious metal, it has since been replaced by gold in this position. Nevertheless, platinum remains in demand due to its exceptional properties and low availability. The high price of platinum results from its rarity and the complex extraction methods: one ounce of platinum, which usually has a purity of 95%, is extracted from ten tons of ore. This extraction process takes around five months.

South Africa is the world's most important producer of platinum and the only country where platinum is mined in pure mines. In addition to South Africa, Russia and Canada also play an important role in platinum production, although the precious metal is mainly a by-product of the extraction of nickel and copper.

Due to its outstanding chemical and physical properties, platinum has a wide range of industrial applications. Due to its high heat resistance, malleability and corrosion resistance, it is mainly used in the automotive industry for catalytic converters, in the chemical and electrical industries and in petroleum refining. Platinum is also used in medicine, for example in chemotherapy or in medical implants. In addition, it remains a popular material for high-quality jewelry due to its luster and rarity.

Interestingly, platinum was discovered and used relatively late in history. It was the chemist Wilhelm Carl Heraeus who first succeeded in making platinum usable by melting it in 1856. The name “platinum” is derived from the Spanish word “platina”, a diminutive of “plata”, which means “silver”. Platinum was possibly already used in ancient Egypt around 3000 BC, as archaeological finds suggest.

Due to the similarities in their properties, palladium is often used as a substitute for platinum, especially in industrial applications. However, palladium has not yet prevailed over platinum in jewelry production.

Platinum is traded on the world's most important commodity markets, including the New York Mercantile Exchange (NYMEX) and the London Platinum & Palladium Market (LPPM). Investors can trade platinum via certificates, warrants or exchange-traded commodities (ETCs).

Analysis

Platinum is the last of the four best-known precious metals that has yet to surpass its pre-corona crisis high. Strictly speaking, according to the Dow Theory, platinum would therefore still be in the “bear market”. However, as the precious metals show a relatively high positive correlation (apart from palladium in recent months), it can be assumed that a higher high in the platinum price is only a matter of time. It is hardly surprising that the platinum price has bounced downwards at around USD 1,000, as this currently represents the upper trend channel limit of a ...

Platinum is the last of the four best-known precious metals that has yet to surpass its pre-corona crisis high. Strictly speaking, according to the Dow Theory, platinum would therefore still be in the “bear market”. However, as the precious metals show a relatively high positive correlation (apart from palladium in recent months), it can be assumed that a higher high in the platinum price is only a matter of time. It is hardly surprising that the platinum price has bounced downwards at around USD 1,000, as this currently represents the upper trend channel limit of a long-term downward trend.

A long-term worst-case target of USD 598 was reached with the coronavirus crash at the end of March. According to Elliott Wave Theory, we have been in a new impulse wave since then. The following two charts show the BIG PICTURE Elliott wave analysis, one with and one without indicators. The indicators have not yet reached the strongly overbought area and allow for further upward potential.

In the following chart, the red bars show how much platinum has lost from the all-time high in the first downward leg to the low. If you draw this downward trend from the high at the end of 2011 downwards, you can see that the low was reached around 8 years later, almost exactly in the area shown.

The following medium-term chart shows that an extension of the correction to around USD 900 and a maximum of USD 875 must be taken into account. After that, dynamic price rises to around USD 1,200 are preferable for the time being.

A global annual production of platinum currently costs around USD 5,000,000,000. Around 90 % of the 200 tons are mined in South Africa, Russia and Canada.

By comparison, around 3,000 tons of gold are mined every year. At current prices, that would be around USD 180,000,000,000.

The price of platinum is currently around 55% below the price of gold. However, the platinum/palladium ratio, which is still at an absolute extreme, is particularly interesting. Platinum is therefore much more interesting for the contrarian.

The CoT data for platinum has brightened considerably more than for gold and is at the same level as when platinum traded at around USD 850 and then rose to over USD 1,000. In the medium to long term, the CoT data continues to look very supportive for further increases in the near future.

Conclusion

- Allow for an extension of the correction to around USD 900 or a maximum of USD 875.

- From then at the latest, the rally should continue in the direction of USD 1,200 for the time being.

Platin

- VALOR 274690

- ISIN IE00B4LHWP62

- Author Oliver Dolezel

- Date 07.10.20

Analysis Performance

Performance since initial analysis

07.10.20

No rating available yet.

Comments

No comments yet.