Gold: Sprint towards new all-time highs?

Purpose

Gold has long been the most sought-after precious metal, both for its cultural and financial value. It has become a tradable asset and is considered a safe haven in turbulent times as its value tends to remain stable.

Gold is mostly found in alloys and only rarely in its pure form. Due to its physical properties, it is resistant to air, moisture, heat and many solvents. Gold is therefore an important industrial raw material. It is easy to process and conducts electricity and heat well. Because of these properties, it is mainly used in the electrical industry. However, ...

Gold has long been the most sought-after precious metal, both for its cultural and financial value. It has become a tradable asset and is considered a safe haven in turbulent times as its value tends to remain stable.

Gold is mostly found in alloys and only rarely in its pure form. Due to its physical properties, it is resistant to air, moisture, heat and many solvents. Gold is therefore an important industrial raw material. It is easy to process and conducts electricity and heat well. Because of these properties, it is mainly used in the electrical industry. However, gold is most commonly used in the jewelry industry, which accounts for around 75% of all gold processed. Gold is mined on every continent in the world except Antarctica, where mining is prohibited.

Global gold reserves have risen steadily in recent decades and are currently at their highest level. This is because gold, unlike other commodities, is virtually indestructible and is not consumed. The highest gold reserves are in the USA (approx. 8,133 tons), followed by Germany (3,417 tons) and the International Monetary Fund (3,217 tons). For a long time, gold was synonymous with money. It lost this role when paper money was introduced and the gold standard was abolished in the 20th century. Nevertheless, gold remains interesting as a store of value. It is traditionally regarded as protection against inflation, as it retains its value in times of rising prices.

Gold has its place in a portfolio, particularly for diversification reasons. In times of high inflation, the weighting in the portfolio should be increased. In normal economic conditions, gold should be considered like any other investment, with advantages and disadvantages. The lack of income and limited capital growth mean that gold's potential is limited compared to securities or other asset classes.

Central banks & gold National banks hold large amounts of gold reserves, even if these fluctuate over time. In the past, a currency was exchanged directly for a certain value of gold, which is no longer the case today. Nevertheless, gold reserves are still theoretically considered a security guarantee for a currency. National banks can still influence the markets by buying or selling gold, but the revelation in 2015 that China's gold reserves were much lower than assumed did little to boost confidence in the precious metal.

Gold against the US dollar The value of gold is usually measured in US dollars, e.g. USD 1,200/ounce. There is an inverse relationship between the US dollar and the price of gold. If the US dollar rises, the price of gold falls, as you can buy more gold with every dollar. Gold also falls when yields on government bonds rise, especially those on 10-year US Treasury bonds. Unlike many other investments, gold does not earn interest. In times of economic uncertainty, which are often accompanied by low interest rates, gold performs well. However, when interest rates rise, gold becomes less attractive as investors switch to other income-producing investments.

There are four main areas of gold demand - jewelry, technology, investors and national banks. Jewelry is the classic use for gold, especially in India and China, where gold jewelry is highly prized.

How to trade gold There are several ways to buy or sell gold. The physical purchase of gold in the form of bars or coins is the oldest method, but also the most expensive, as storage costs are incurred. An alternative is to trade via ETFs, which track the price of gold on the global markets. This is a cheap and easy method for private investors. Another way is to trade CFDs, which offer similar benefits to ETFs, but are leveraged products and should be treated with caution. Finally, you can buy and sell shares in gold mining companies, which are highly correlated with the gold price.

The most important trading centers for gold are Zurich, London, New York and Hong Kong. The most important exchanges are the New York Mercantile Exchange (COMEX), the Chicago Board of Trade, Euronext/LIFFE, the London Bullion Market and the Tokyo Commodity Exchange.

Analysis

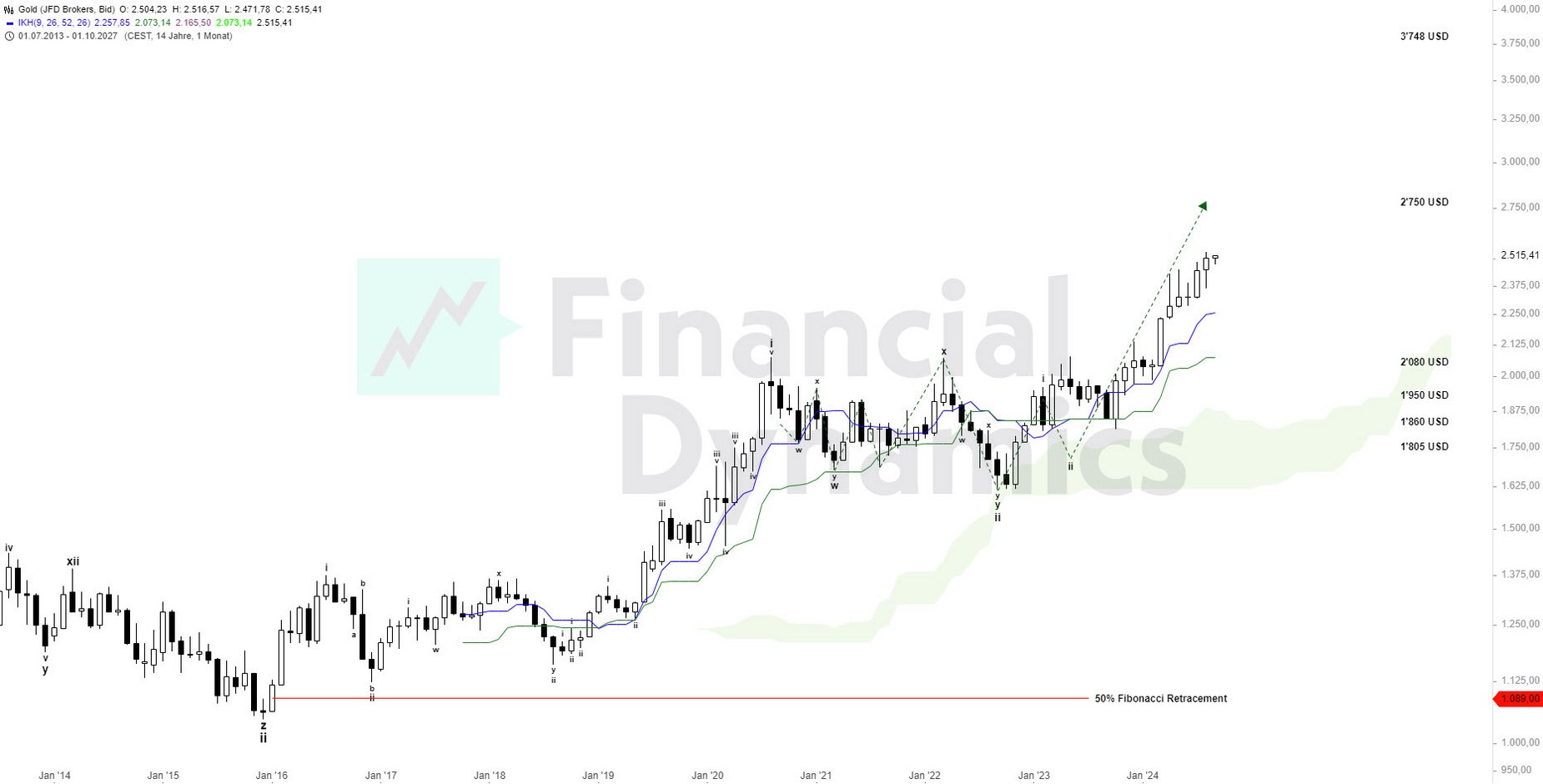

The price of gold in US dollars has already risen by over 71% at times since its low - and this for an asset that has no default or counter risks. Contrary to the conviction of the richest investor of all time, Warren Buffett, the yellow precious metal has thus continuously worked its way upwards. Buffett, the Chairman and CEO of Berkshire Hathaway, has repeatedly made negative comments about gold in recent years.

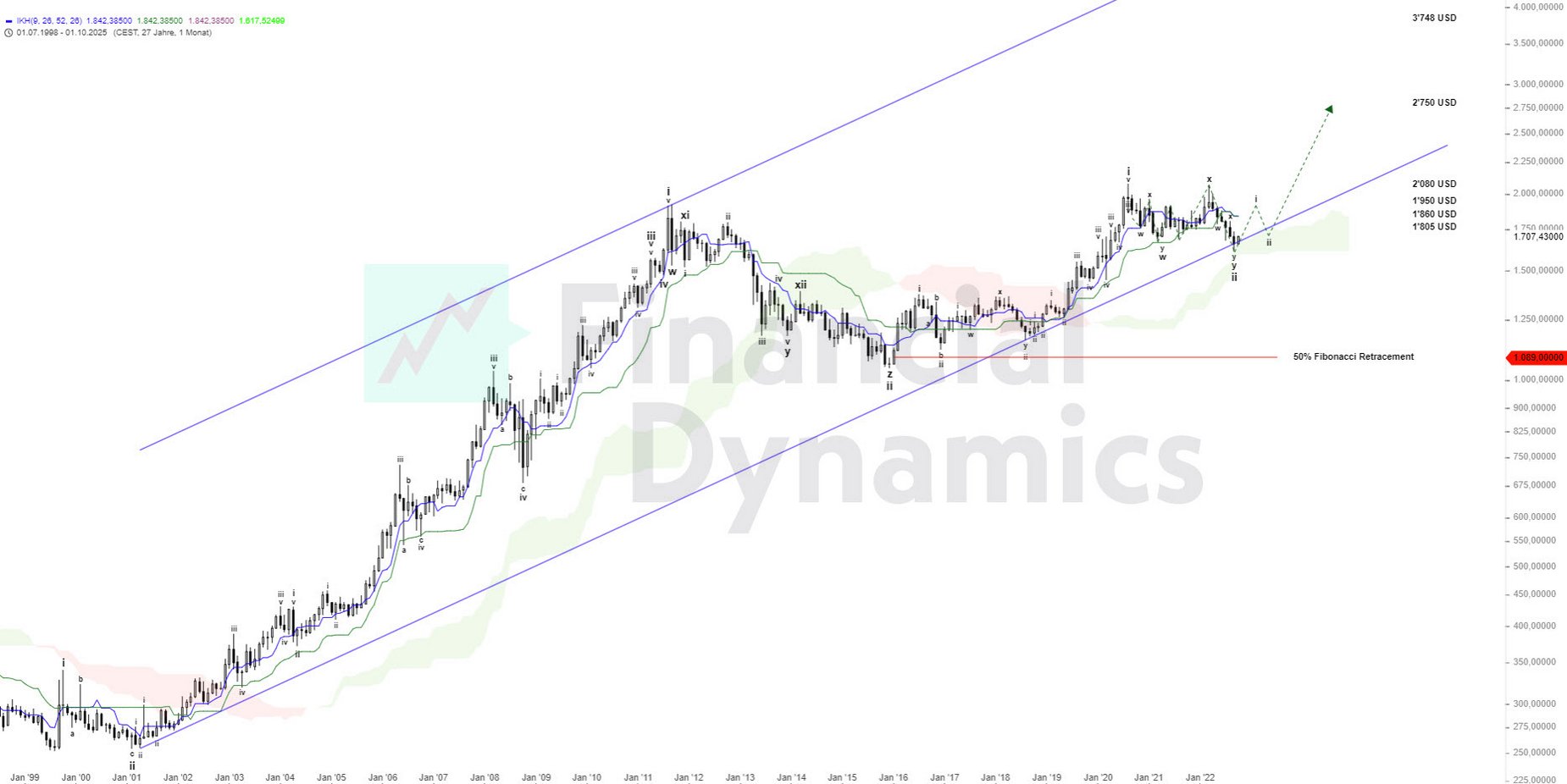

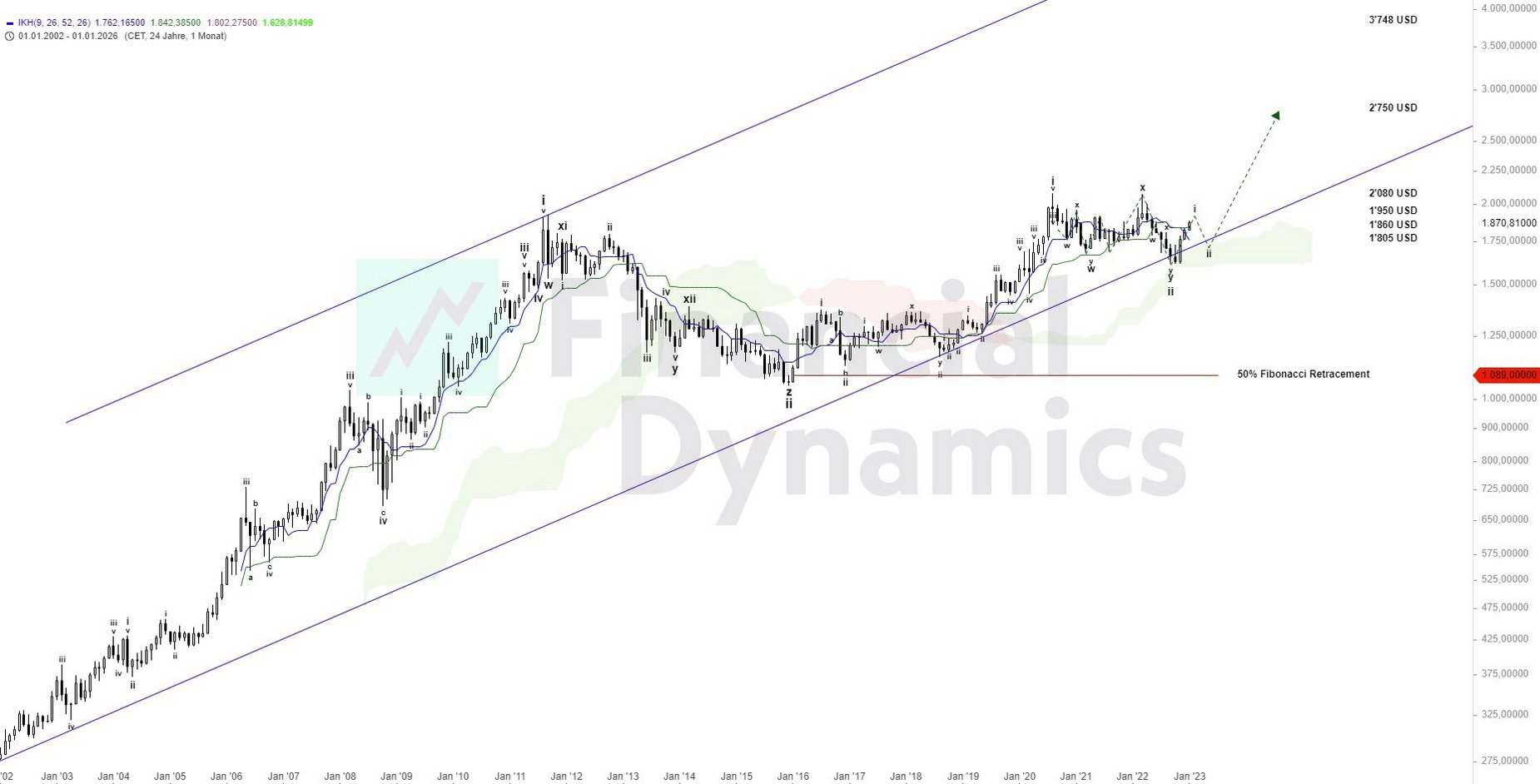

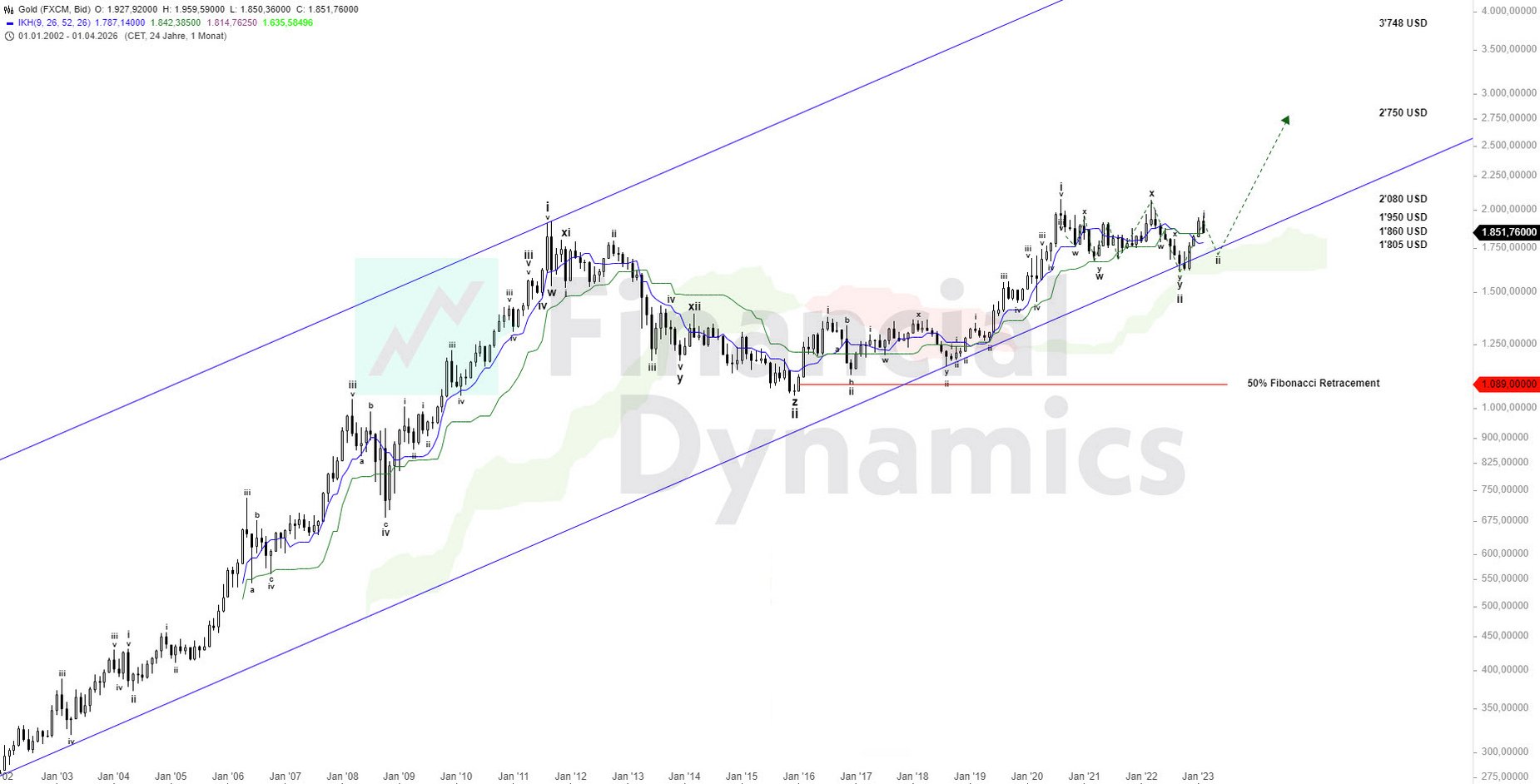

According to the Elliott Wave Theory, a significant cycle was completed in a wave “i” in September 2011. In December 2015, the corrective wave “z” of wave ...

The price of gold in US dollars has already risen by over 71% at times since its low - and this for an asset that has no default or counter risks. Contrary to the conviction of the richest investor of all time, Warren Buffett, the yellow precious metal has thus continuously worked its way upwards. Buffett, the Chairman and CEO of Berkshire Hathaway, has repeatedly made negative comments about gold in recent years.

According to the Elliott Wave Theory, a significant cycle was completed in a wave “i” in September 2011. In December 2015, the corrective wave “z” of wave “ii” ended after 51 months. Since then, the gold price has been in a new impulse wave. The fractals of the bull market from 2001 to 2011 suggest that price targets well above the USD 2,500 mark are possible. The long-term Elliott wave count suggests that the gold price could very soon enter a more volatile sideways phase before the upward phase continues. The overall picture remains clearly bullish. After the rally of over 71% since the low, it would not be surprising if the price were to take a short break at the current important resistance area.

The medium-term Elliott wave count shows that the upward movements of an internal wave “iii” are almost complete. There could therefore be a correction in the price to around USD 1,800-1,820, which could push the gold price back down to around USD 1,700. According to the Elliott waves, corrections in bull markets are difficult to forecast precisely, as the probability that the trend will continue directly upwards without significant corrections is relatively high in an impulse wave.

According to the latest report, the CoT data has deteriorated slightly, but is still relatively far from bearish extremes. The red bar in the table shows that producers and swap dealers in particular have increased their short positions relatively sharply. The commercials' positions on the USD signal a small warning. This is because the commercials are more bullishly positioned on the USD index than they have been for a long time and at the same time extremely bearish on the EUR/USD pair. The commercials are therefore expecting the US dollar to strengthen soon. And since precious metals correlate negatively with the US dollar in most market phases, this is at least a small warning sign for the coming weeks.

The central bank system causes “boom & bust” cycles. In 2000 we had the dotcom bubble, seven years later the subprime bubble. Now we have the everything bubble (except precious metals).

In terms of sentiment, there is still no sign of euphoria. The Google Trends chart shows that search queries are still a long way from the highs of August/September 2011, when the gold price reached its all-time high of over USD 1,900. If you enter “gold” in Google News, you can see a slight optimism, but no USD 5,000 price targets are mentioned, as was the case in 2011, for example.

Conclusion

- Potential for new highs: The overall trend suggests that a new all-time high in the gold price could be reached soon, despite possible setbacks and chart resistance.

- Elliott Wave Theory: According to the Elliott Wave Theory, a fall to USD 1,500 is conceivable, but would not significantly affect the overall positive market picture. Corrections are part of the natural course of the market and should not be overestimated.

- Long-term price targets: The analysis suggests that the long-term price targets for gold could rise significantly above USD 2,500 and even above USD 10,000, especially considering the developments in other currencies and markets where gold has already shown massive upward movements.

Gold

- VALOR 274702

- ISIN IE00B4ND3602

- Author Oliver Dolezel

- Date 02.07.20

Analysis Performance

Performance since initial analysis

02.07.20

No rating available yet.

Comments

No comments yet.