Brent-Rohöl: Oil and stock markets near potential lows?

Purpose

Smartphones, laptops, cosmetics, furniture, heart valves, fuel - crude oil will continue to be a basic material in our everyday lives for many years to come. Too precious in the long term as a fuel or heating agent, it is indispensable in the chemical industry in particular. Crude oil is currently the most important raw material for modern industrial societies. Brent is the most important type of crude oil for Europe. (Brent Blend is actually traded, a mix mainly from the Brent and Ninian fields). Brent is light crude oil (low sulphur content). It comes from the North ...

Smartphones, laptops, cosmetics, furniture, heart valves, fuel - crude oil will continue to be a basic material in our everyday lives for many years to come. Too precious in the long term as a fuel or heating agent, it is indispensable in the chemical industry in particular. Crude oil is currently the most important raw material for modern industrial societies. Brent is the most important type of crude oil for Europe. (Brent Blend is actually traded, a mix mainly from the Brent and Ninian fields). Brent is light crude oil (low sulphur content). It comes from the North Sea between the Shetland Islands and Norway. From there it travels via an underwater pipeline to the Sullom Voe oil terminal on Mainland, Shetland (as does the oil from the Ninian field), and is transported onwards by tanker.

Before the pipeline and oil terminal were completed, the oil was loaded onto tankers in the North Sea from loading platforms such as the Brent Spar. It is traded in London on the International Petroleum Exchange. The two oil fields Brent and Ninian have now exceeded their production maximum (peak oil). The Brent field borders the Norwegian Statfjord field to the east; there is a transfer pipeline between the two fields. The Brent oil field is being developed by Shell UK Ltd. and Esso Exploration & Production UK Ltd. It was discovered in 1971 and has been in production since 1976, in the “Brent South” sub-field since August 1992.

Analysis

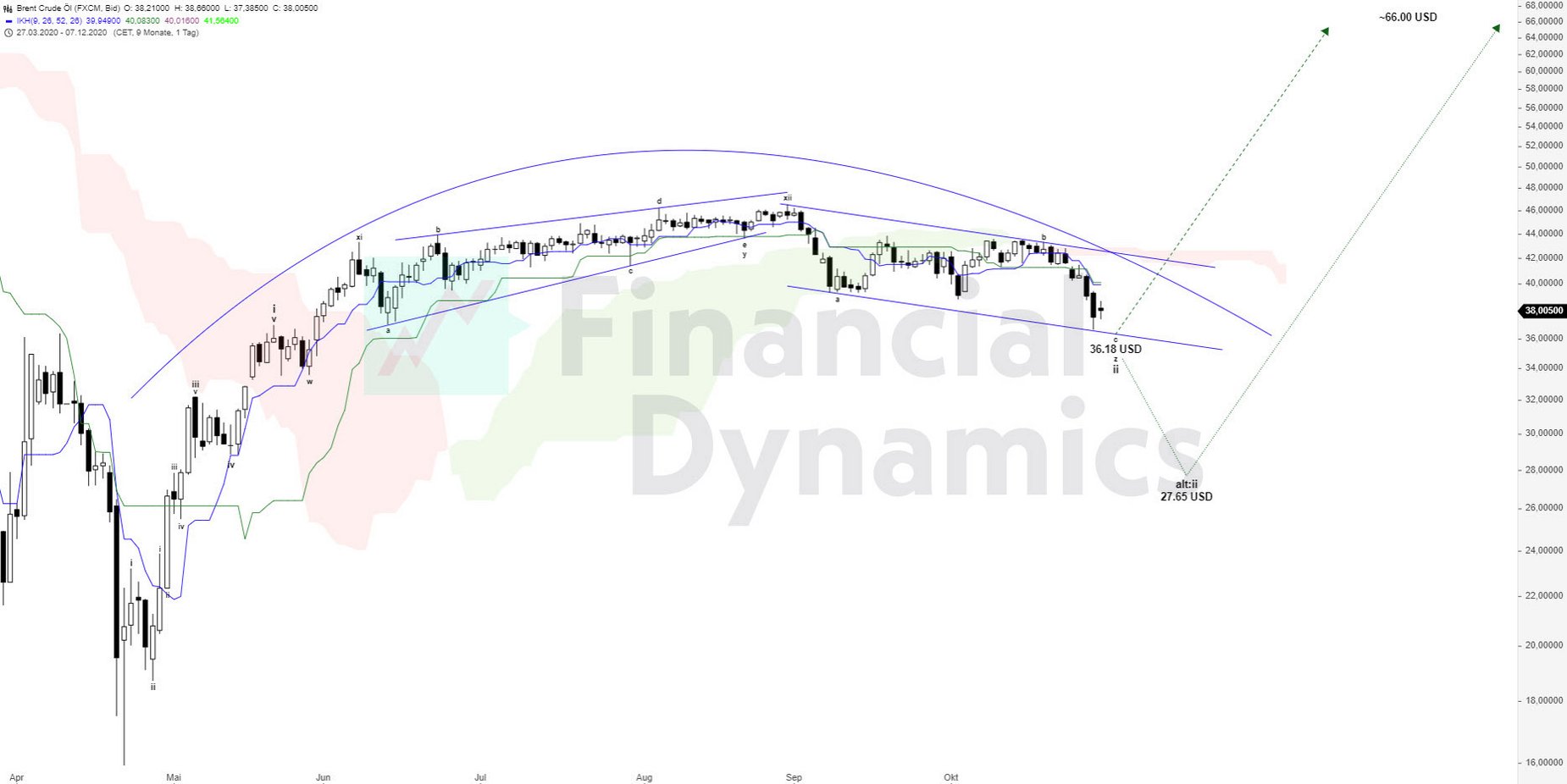

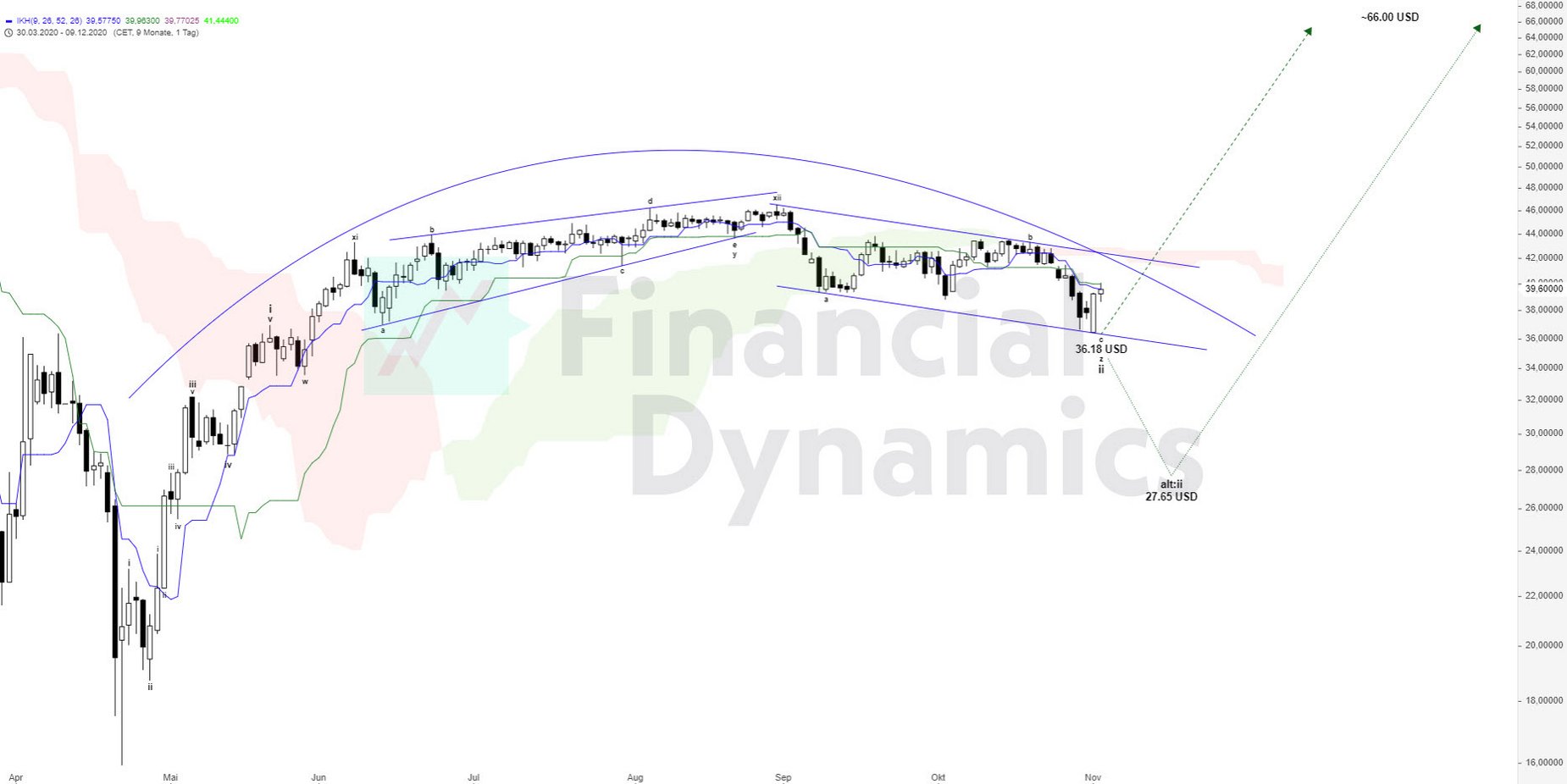

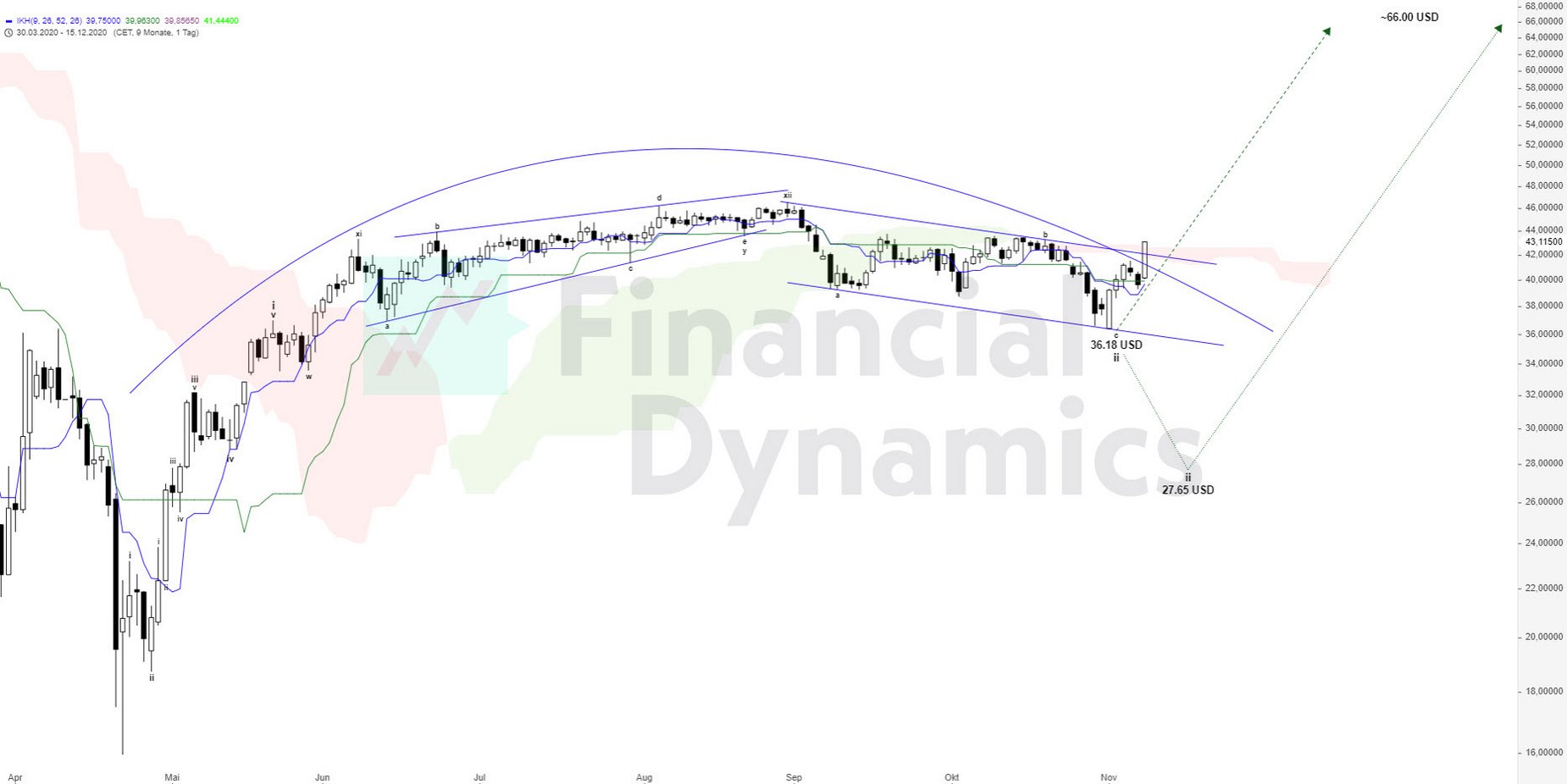

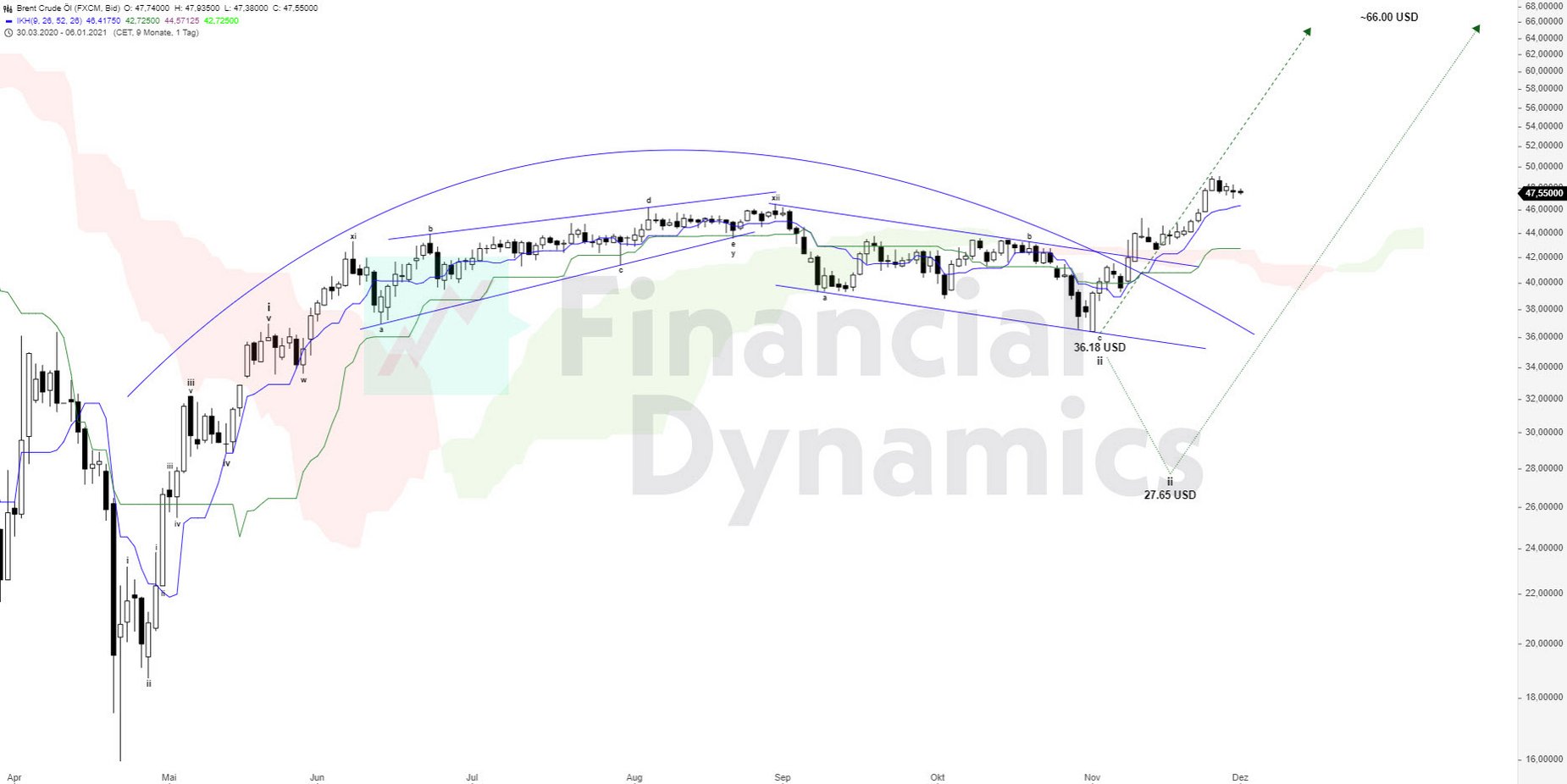

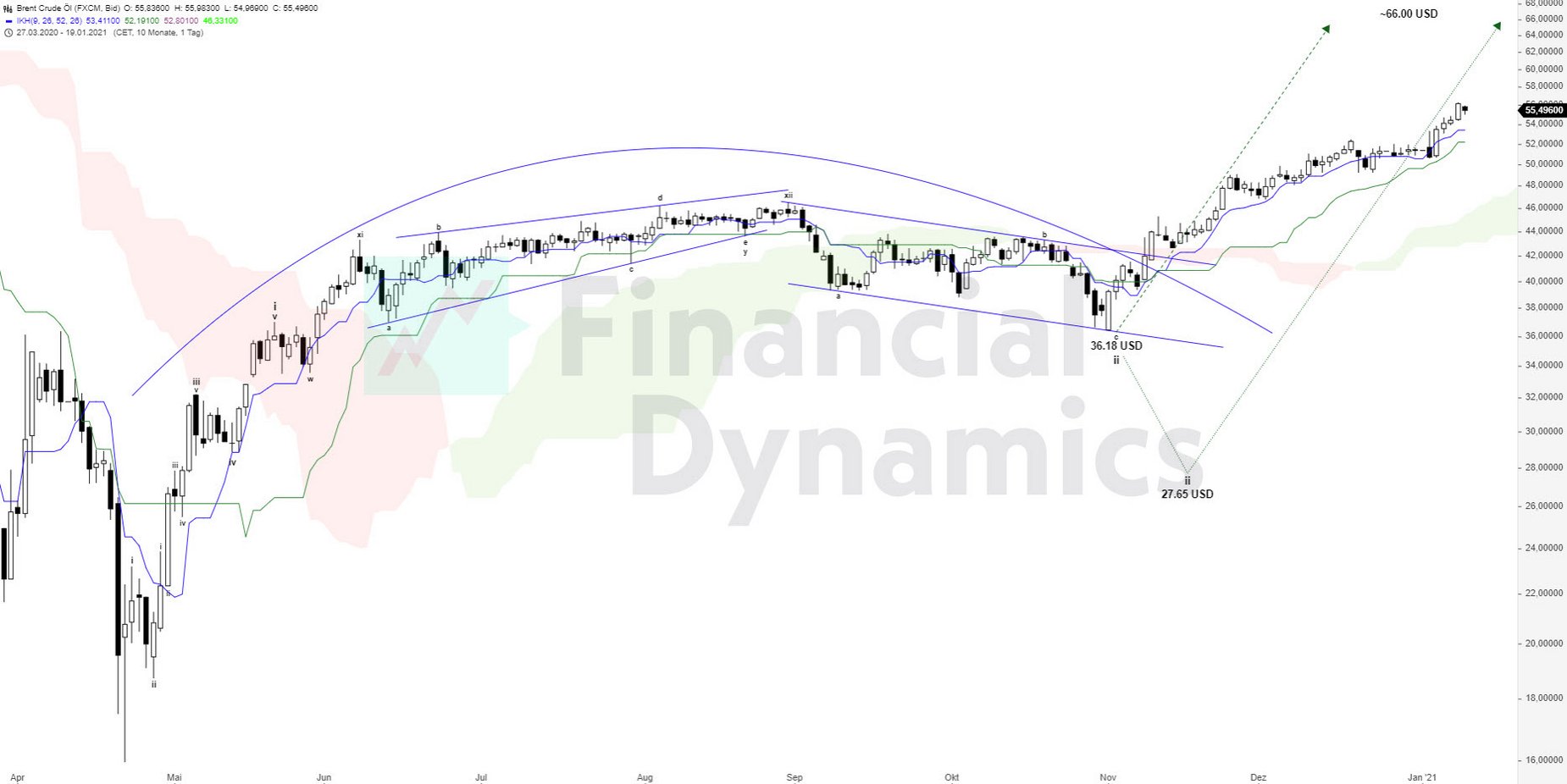

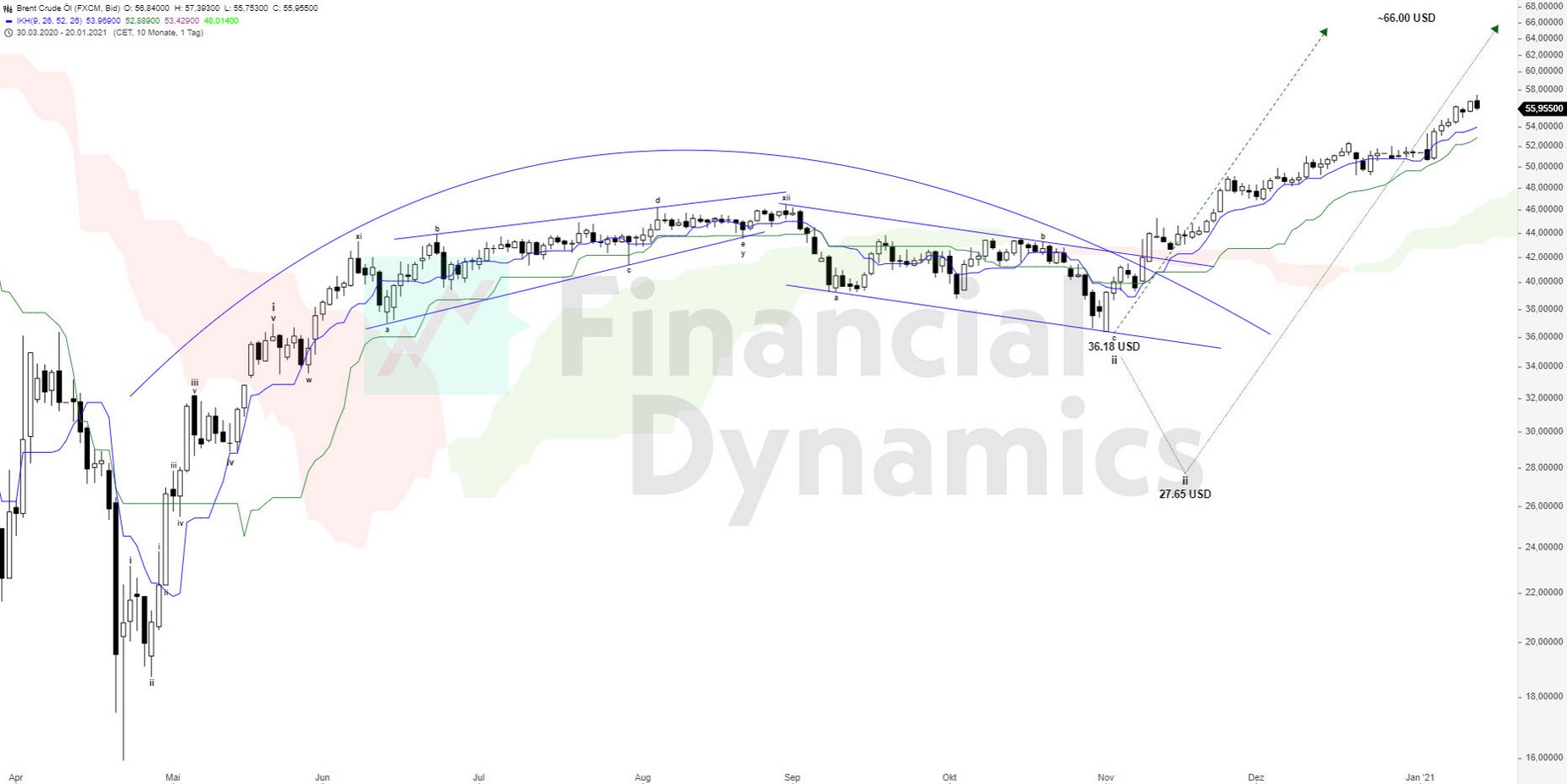

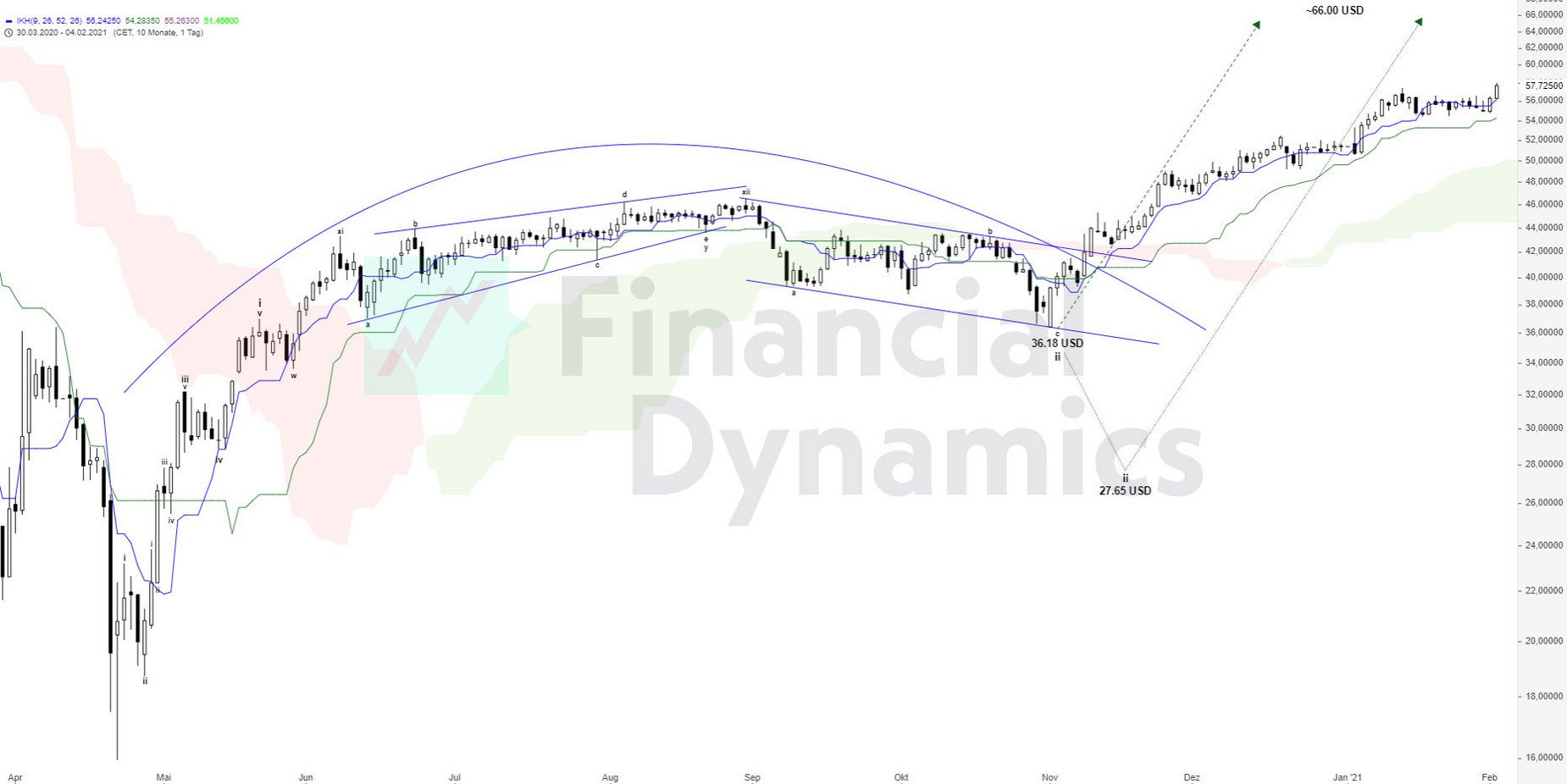

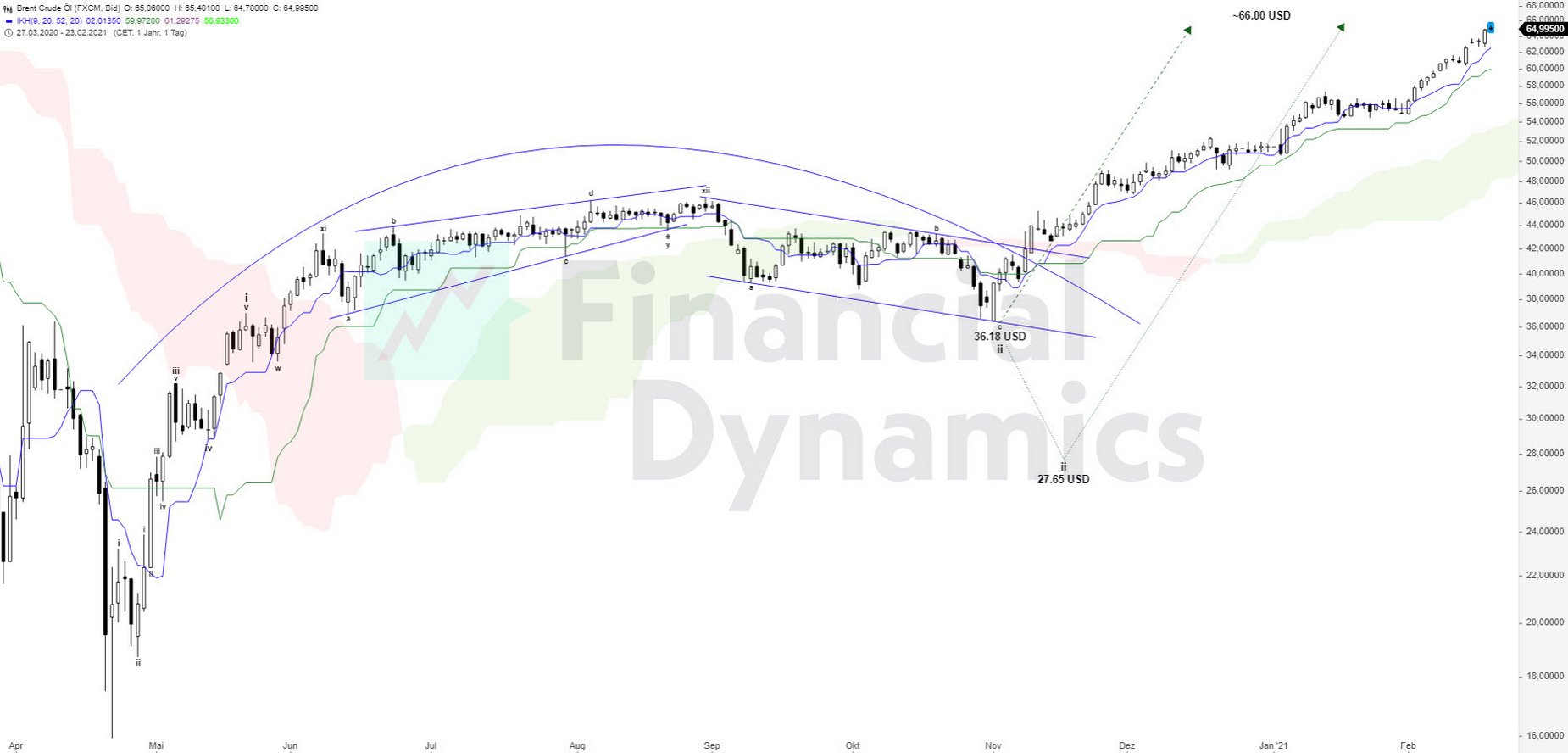

In the current market situation, some indicators suggest that both the Brent oil price and the S&P 500 Index could be near potential lows. Our analysis shows two scenarios: The main scenario, represented by the dashed green arrow, signals a potential upward trend reversal, while the alternative scenario, marked by the dotted green arrow, indicates continued uncertainty. According to our main scenario, a Brent oil price of USD 36.18 in particular could form the basis for an upward impulse.

Conclusion

- Potential target for the trend reversal in the Brent oil price at USD 36.18

- More detailed analysis of price patterns at the support level is necessary.

Brent-Rohöl

- VALOR 274207

- ISIN XC0009677409

- Author Oliver Dolezel

- Date 30.10.20

Analysis Performance

Performance since initial analysis

30.10.20

No rating available yet.

Comments

No comments yet.