Ethereum: Is Bitcoin's little brother about to break out?

Purpose

Ethereum is one of the best-known cryptocurrencies alongside Bitcoin. “Ether” (ETH) is the currency unit of the Ethereum network, of which there are currently around 120 million in circulation. With a market capitalization of around 407 billion euros (as at 15 March 2024), Ethereum is the second-largest crypto system in the world after Bitcoin.

But Ethereum is far more than just a digital currency. It is a decentralized network based on blockchain technology, similar to Bitcoin. The big difference is that Ethereum not only enables simple transactions, but can also ...

Ethereum is one of the best-known cryptocurrencies alongside Bitcoin. “Ether” (ETH) is the currency unit of the Ethereum network, of which there are currently around 120 million in circulation. With a market capitalization of around 407 billion euros (as at 15 March 2024), Ethereum is the second-largest crypto system in the world after Bitcoin.

But Ethereum is far more than just a digital currency. It is a decentralized network based on blockchain technology, similar to Bitcoin. The big difference is that Ethereum not only enables simple transactions, but can also execute so-called smart contracts. These intelligent contracts are automated programs that execute certain actions as soon as predefined conditions are met. This opens up a wide range of possible applications, such as in decentralized finance (DeFi).

All participants in the Ethereum network access a shared database that is secured by the Ethereum blockchain. To participate in the network, you need a so-called Ethereum client. This synchronizes with the network before use by downloading and checking all transactions documented since the last synchronization. There are various Ethereum clients that have been created by different developer groups to keep the network decentralized and secure. For faster synchronization, some clients offer a quick mode that does not download the entire blockchain.

Wallets are used to store and manage ether and other tokens on the Ethereum blockchain. Popular wallets include MyEtherWallet, MyCrypto, Metamask or hardware wallets such as Ledger. Even browsers such as the Opera crypto browser support the use of Ethereum.

Analysis

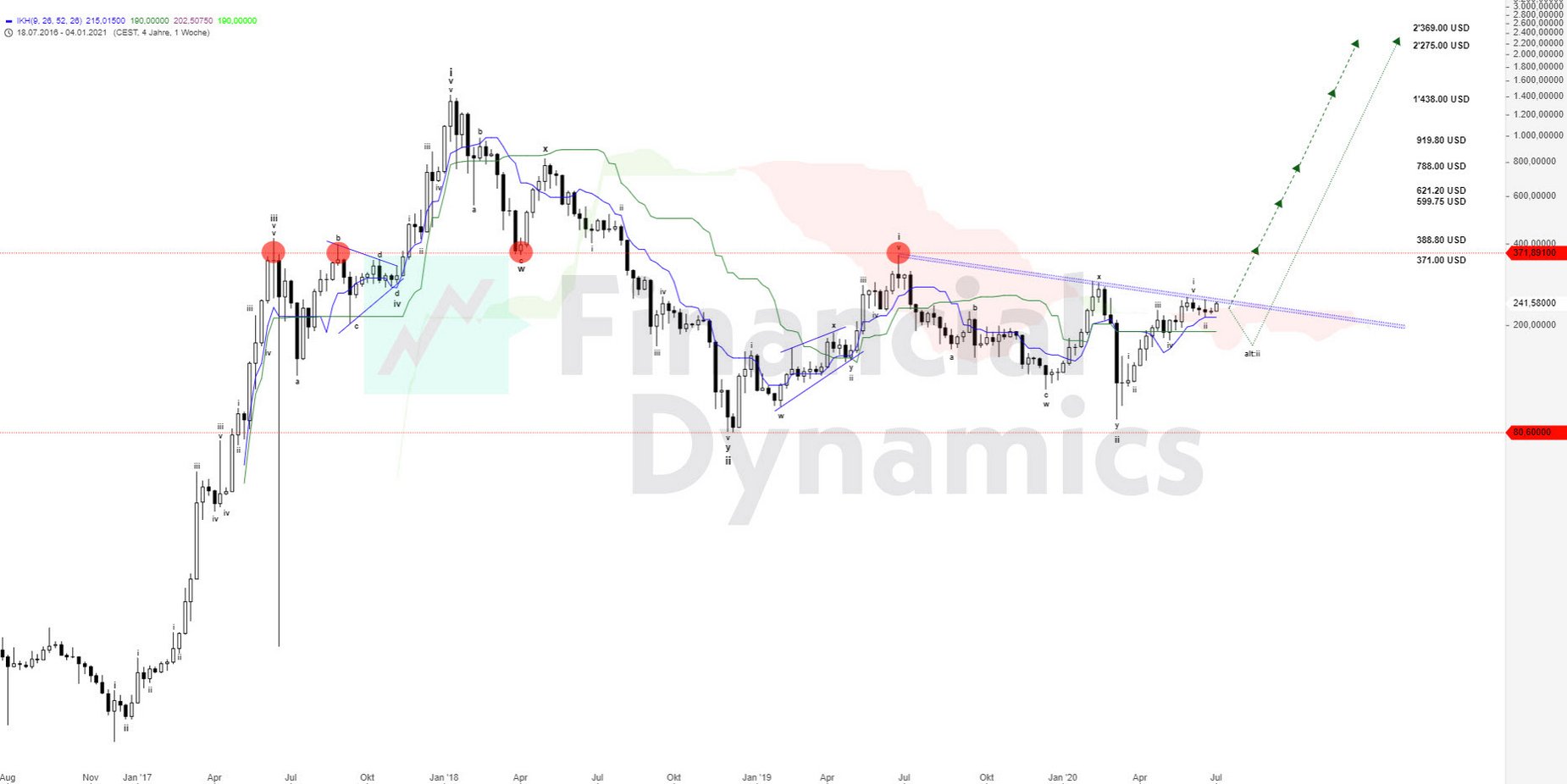

According to the Elliott Wave Theory, Ethereum's chart looks much less harmonious than that of Bitcoin. The price is currently at the dominant downtrend line since June 2019.

In the BIG PICTURE (longterm), Ethereum should have completed a wave “ii” or “b” in December 2018. Since then, there has been a sideways phase between approx. USD 80 and USD 370 with lower highs. Resistance should be expected in the area of the dominant downtrend edge and a more complex wave “ii” should be planned. Specifically: A renewed slump to the USD 160 range cannot be completely ruled out. ...

According to the Elliott Wave Theory, Ethereum's chart looks much less harmonious than that of Bitcoin. The price is currently at the dominant downtrend line since June 2019.

In the BIG PICTURE (longterm), Ethereum should have completed a wave “ii” or “b” in December 2018. Since then, there has been a sideways phase between approx. USD 80 and USD 370 with lower highs. Resistance should be expected in the area of the dominant downtrend edge and a more complex wave “ii” should be planned. Specifically: A renewed slump to the USD 160 range cannot be completely ruled out. Only a sustained rise above USD 260 would be a clear sign that subsequent rises to USD 371, 388.80, 599.75 and 621.20 are possible in the coming weeks.

The statistical average annual trend of the last four years shows that seasonality is still negative until the beginning of December.

Conclusion

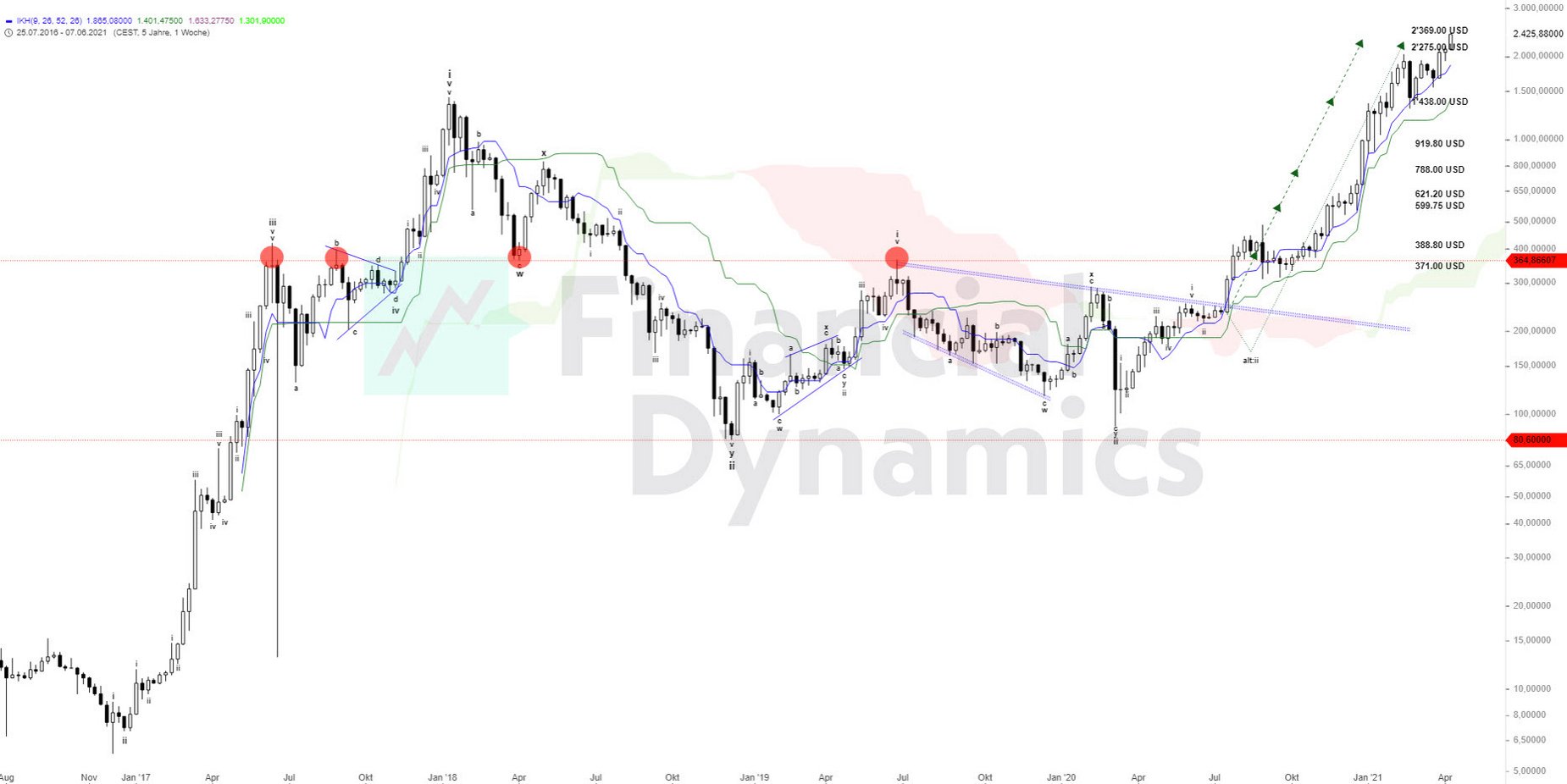

- Following the completion of wave “ii”, Ethereum has a chance of rising towards USD 371 for the time being. Subsequently, significantly higher price targets would be possible.

- Either wait for the buy signal at USD 260 and place a stop below the low of USD 216 on June 27, 2020, or enter the market immediately, but then have few opportunities to place a meaningful stop.

Ethereum

- VALOR 45466402

- ISIN CH0454664027

- Author Oliver Dolezel

- Date 02.07.20

Analysis Performance

Performance since initial analysis

02.07.20

No rating available yet.

Comments

No comments yet.