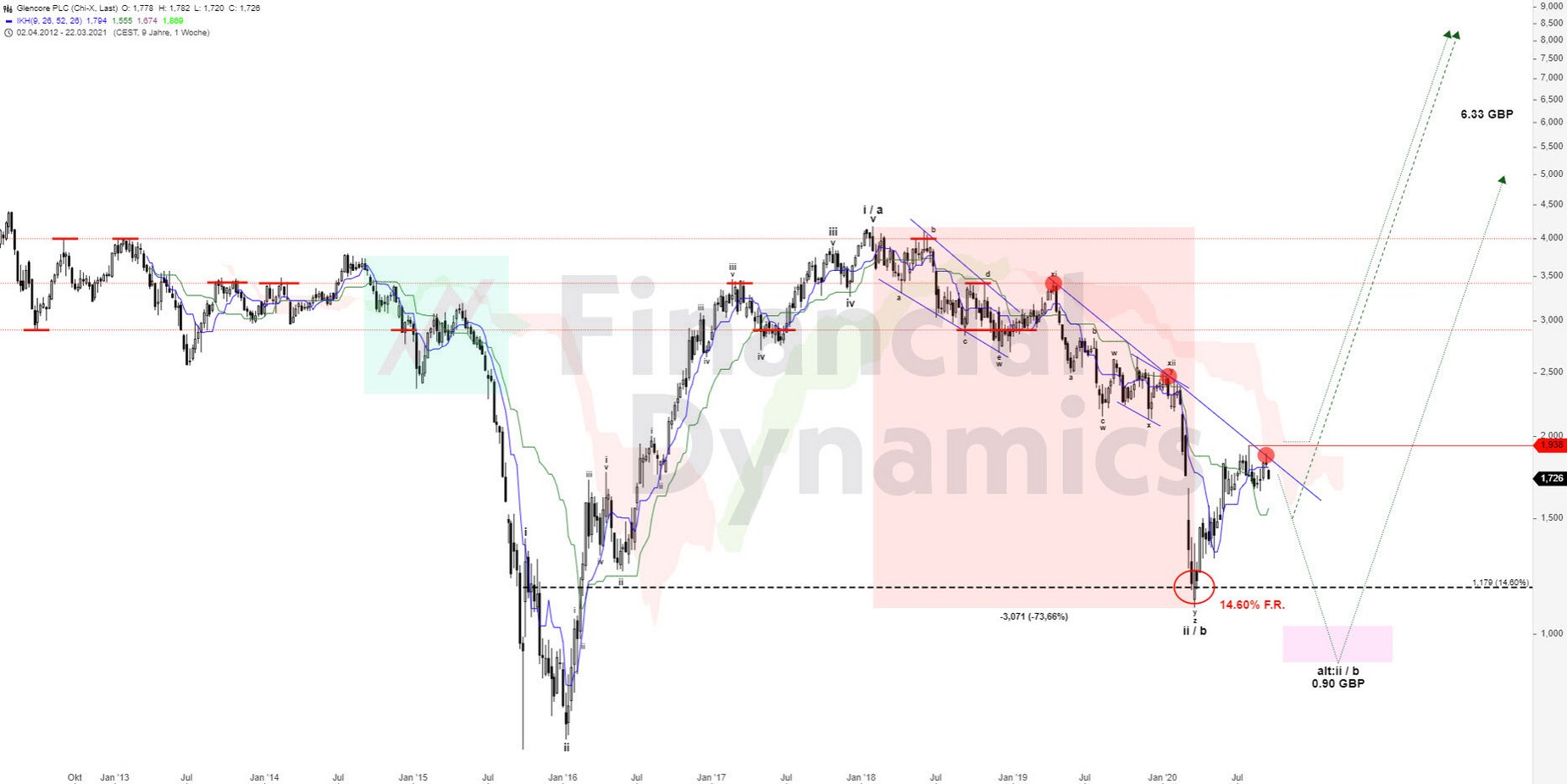

Glencore: Does the GBP 1.10 low hold?

Purpose

Glencore is one of the world's largest commodity traders, operating in the metals and minerals, energy products and agricultural commodities markets through its 50% stake in Viterra. The company's marketing division provides sourcing, logistics, transportation, storage and financing services to commodity producers and consumers around the world. The merger with the diversified mining company Xstrata in 2013 made Glencore one of the largest commodity producers in the world. The company is primarily involved in the production of steam coal, coking coal, copper, zinc, ...

Glencore is one of the world's largest commodity traders, operating in the metals and minerals, energy products and agricultural commodities markets through its 50% stake in Viterra. The company's marketing division provides sourcing, logistics, transportation, storage and financing services to commodity producers and consumers around the world. The merger with the diversified mining company Xstrata in 2013 made Glencore one of the largest commodity producers in the world. The company is primarily involved in the production of steam coal, coking coal, copper, zinc, nickel, cobalt and ferroalloys. Unlike other large mining companies, Glencore plans to continue producing thermal coal until its mines are exhausted, arguing that it is better for listed Western companies to own these assets and then rehabilitate them to Western standards.

Glencore, headquartered in Baar, Switzerland, with its registered office in Jersey, is one of the world's leading companies in the commodities sector following its acquisition of mining group Xstrata in May 2013. The Group's business activities are divided into the Metals and Minerals, Energy Products and Agricultural Products divisions, which are supported by the Marketing and Logistics division.

The company operates internationally in the production, procurement, processing, refining, transportation, storage and trading of metals and minerals, energy and agricultural products. The Group is also active in the mining, processing, refining and storage of copper, ferrochrome, nickel, vanadium, zinc, coking coal, thermal coal and oil, as well as platinum metals, gold, cobalt, lead and silver. The Group operates over 150 mining and mining facilities, offshore oil production facilities, farms and agricultural facilities worldwide.

Unlike other large mining companies, Glencore plans to continue producing thermal coal until its mines are exhausted, arguing that it is better for listed, Western companies to own these assets and then rehabilitate them to Western standards. Glencore serves its clients in over 50 countries through a global network of more than 90 offices. Companies operating in the same sector include Alcoa, Anglo American, Aurubis, BHP Billiton and Rio Tinto.

Analysis

The contrarian buys assets that are otherwise avoided by almost everyone and are undervalued. As already mentioned in the BIG PICTURE gold analysis, there are still plenty of these in the commodities sector at the moment. As can be seen from the following chart, the commodities market is more undervalued than ever before compared to the equity market. One share that could benefit from this possible trend reversal is Glencore.

According to the EW theory, the main scenario would be a fall to around GBP 1.50 and then a long-term bull market. The worst-case scenario ...

The contrarian buys assets that are otherwise avoided by almost everyone and are undervalued. As already mentioned in the BIG PICTURE gold analysis, there are still plenty of these in the commodities sector at the moment. As can be seen from the following chart, the commodities market is more undervalued than ever before compared to the equity market. One share that could benefit from this possible trend reversal is Glencore.

According to the EW theory, the main scenario would be a fall to around GBP 1.50 and then a long-term bull market. The worst-case scenario calculates a renewed lower low below GBP 1.10 at around GBP 0.90. A procyclical buy signal would emerge above GBP 1.94. The reader should interpret the following data concerning “fundamentals” in the light of the fact that Glencore has now had to contend with record low commodity prices for years.

Conclusion

- There are currently two options that I would prefer as a course of action: either buy the share when the procyclical buy signal is triggered above GBP 1.94, or wait for a slide into the GBP 1.50 area and then buy it.

Glencore

- VALOR 12964057

- ISIN JE00B4T3BW64

- Author Oliver Dolezel

- Date 23.09.20

Analysis Performance

Performance since initial analysis

23.09.20

No rating available yet.

Comments

No comments yet.