Uber: A good CRV

Purpose

Uber Technologies is a technology and mobility network provider that connects people with on-demand services via an app. The app provides its users with access to alternative transportation options, food delivery services and freight and courier services. The app also connects customers with public transportation and other personal mobility solutions such as e-bikes or e-scooters. The company's on-demand technology platform could be used for other products and services in the future, e.g. for the delivery of autonomous vehicles via drones and Uber Elevate, which, ...

Uber Technologies is a technology and mobility network provider that connects people with on-demand services via an app. The app provides its users with access to alternative transportation options, food delivery services and freight and courier services. The app also connects customers with public transportation and other personal mobility solutions such as e-bikes or e-scooters. The company's on-demand technology platform could be used for other products and services in the future, e.g. for the delivery of autonomous vehicles via drones and Uber Elevate, which, according to the company, offers ridesharing from the air. Uber Technologies is headquartered in San Francisco and operates in over 63 countries with more than 110 million users who order rides or food at least once a month. Uber's services are available in numerous countries around the world, primarily in the United States, Canada, Latin America, Europe, the Middle East, Africa and Asia (excluding China and Southeast Asia).

Analysis

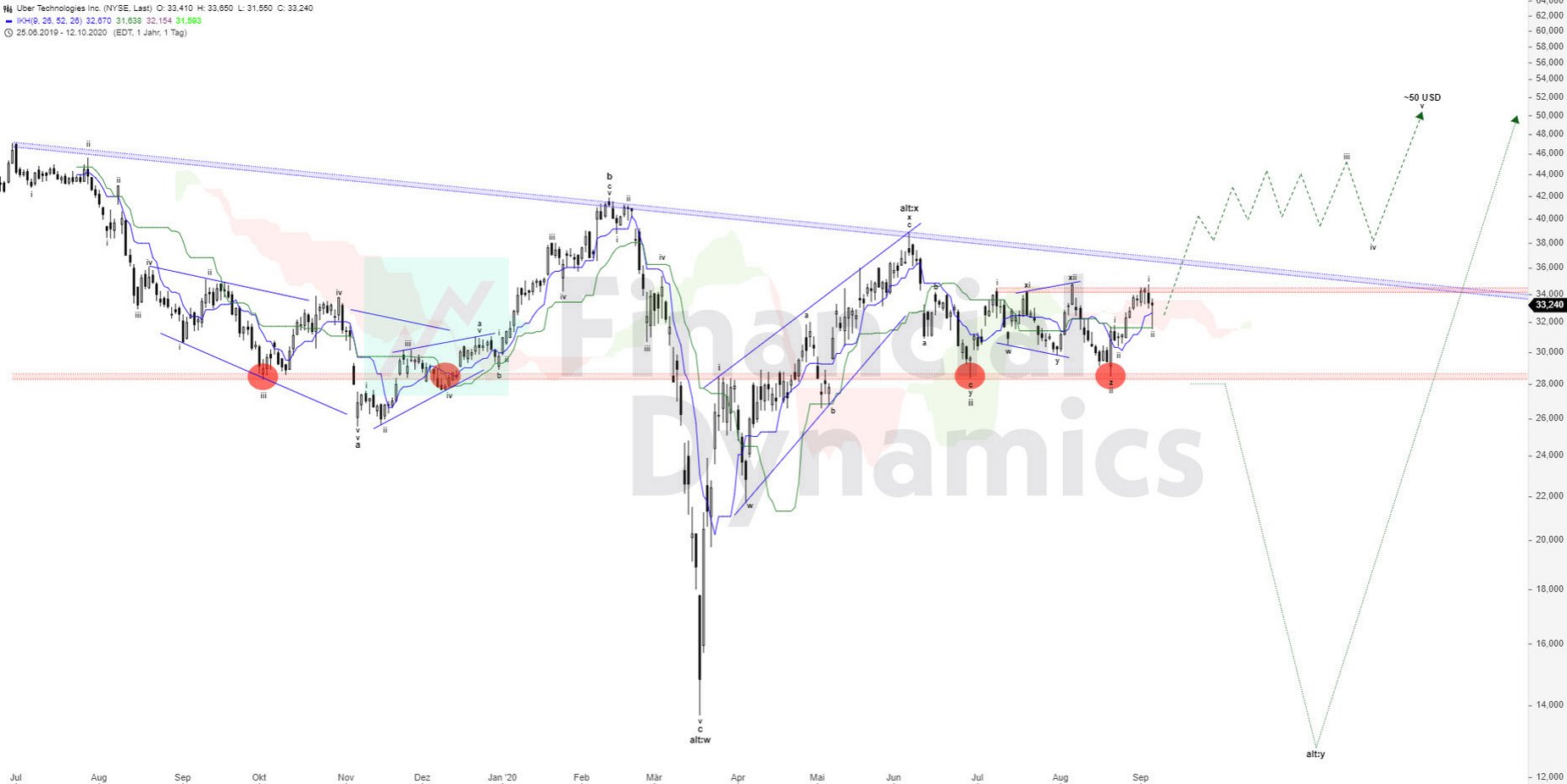

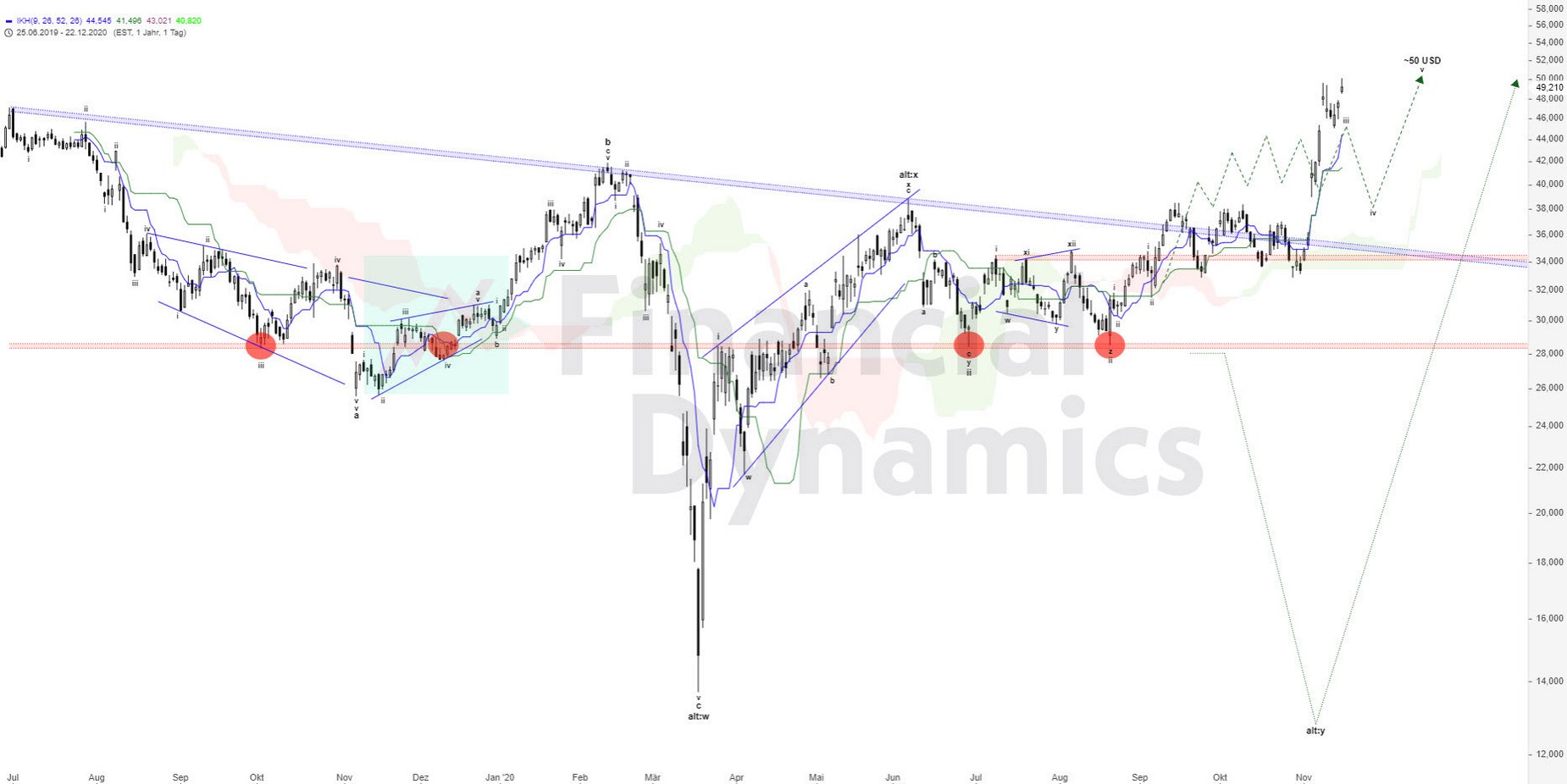

There are stocks that have clearer fractals than UBER. However, if you combine the EW theory with classic technical analysis, the CRV (risk/reward ratio) for a potential entry into the share does not look bad.according to the EW theory, the share could have a rise towards around USD 50 ahead of it as long as it is trading above USD 28. However, there are still some strong resistances in the USD 34-37 range that need to be overcome.

Conclusion

- As long as the share is trading above the USD 28 mark, there is always a chance of a rise towards around USD 50 (for the time being).

- However, an initial warning sign that the direct rise could fail would be a drop below USD 31.57.

- Below USD 28, a second leg of correction threatens with price targets below USD 13.75.

Uber

- VALOR 47459333

- ISIN US90353T1007

- Author Oliver Dolezel

- Date 05.09.20

Analysis Performance

Performance since initial analysis

05.09.20

No rating available yet.

Comments

No comments yet.